If you’ve ever wondered about transferring gold investment as a gift to someone in Malaysia, we’ve got just the information you need. In this article, we’ll explore the possibilities and intricacies of gifting gold investments in a friendly and approachable manner. Whether you’re a seasoned gold investment expert or simply curious about the process, we’ll provide you with a comprehensive guide complete with proper headings, relevant videos, and engaging content to ensure an enjoyable read. So, let’s dive into the world of gold gift transfers in Malaysia!

Overview

Gold investment is a popular option for individuals looking to diversify their investment portfolio and protect against inflation. Transferring gold investment as a gift in Malaysia is a thoughtful and unique way to celebrate special occasions and milestones. In this article, we will explore the basics of gold investment, the benefits it offers, and the process of transferring gold investment as a gift.

Understanding Gold Investment

Definition of gold investment

Gold investment refers to the practice of purchasing gold with the intention of generating a return on investment. Unlike traditional forms of investment such as stocks or real estate, gold investment involves owning physical gold in the form of bullion, coins, or bars.

Types of gold investments

There are several ways to invest in gold, each with its own advantages and considerations. Some common types of gold investments include:

Physical gold: This involves purchasing physical gold in the form of bullion, coins, or bars. Physical gold offers the advantage of tangibility, allowing investors to hold and store the precious metal themselves.

Gold ETFs: Gold Exchange-Traded Funds (ETFs) are investment products that track the price of gold. Investing in gold ETFs provides exposure to the price movement of gold without the need for physical ownership.

Gold mining stocks: Investing in gold mining companies allows investors to gain exposure to the gold industry indirectly. The value of these stocks is influenced by factors such as gold prices, production costs, and company performance.

Factors to consider in gold investment

Before diving into gold investment, it is essential to consider various factors that can affect the value and profitability of your investment. Some key factors to consider include:

Gold prices: The price of gold is influenced by numerous factors, including supply and demand dynamics, economic conditions, and geopolitical events. It is crucial to stay updated on gold price trends to make informed investment decisions.

Storage options: If you choose to invest in physical gold, you must consider secure storage options. This may include keeping the gold in a safe at home, renting a safe deposit box at a bank, or utilizing specialized gold storage facilities.

Market liquidity: Liquidity refers to how easily an investment can be bought or sold without causing significant price fluctuations. Gold is generally considered a liquid asset, meaning it can be easily sold for cash when needed.

Benefits of Gold Investment

Hedge against inflation

One of the primary benefits of gold investment is its ability to act as a hedge against inflation. Inflation refers to the increase in the general price level of goods and services over time. As inflation erodes the purchasing power of fiat currencies, the value of gold tends to rise. By investing in gold, you can protect the real value of your wealth against the effects of inflation.

Diversification of investment portfolio

Another significant advantage of gold investment is its ability to diversify an investment portfolio. Diversification involves spreading investments across different asset classes to mitigate risk. Since the value of gold is often uncorrelated with other investments such as stocks and bonds, adding gold to a portfolio can help reduce overall investment volatility.

Liquidity and tangibility

Gold investment offers the benefits of both liquidity and tangibility. Unlike some other investments that may have restrictions on when and how they can be sold, gold can be easily sold in the open market. Additionally, gold is a physical asset that can be held and touched, providing a sense of security and reassurance to investors.

Transferring Gold Investment as a Gift

Legality of transferring gold investment in Malaysia

In Malaysia, transferring gold investment as a gift is legal and relatively straightforward. However, it is essential to consider any relevant regulations or restrictions that may apply. It is advisable to consult with a financial advisor or tax professional to ensure compliance with all relevant laws and regulations.

Considerations before transferring gold investment

Before transferring a gold investment as a gift, there are several factors to consider:

Suitability of gold investment: Ensure that the recipient has an interest in gold investment and understands the potential risks and rewards associated with it.

Financial implications: Consider the financial impact on the recipient, including any tax obligations or potential costs associated with the transfer.

Long-term commitment: Gold investment is typically a long-term commitment. Ensure that the recipient intends to hold onto the investment for an extended period and understands the potential fluctuations in value.

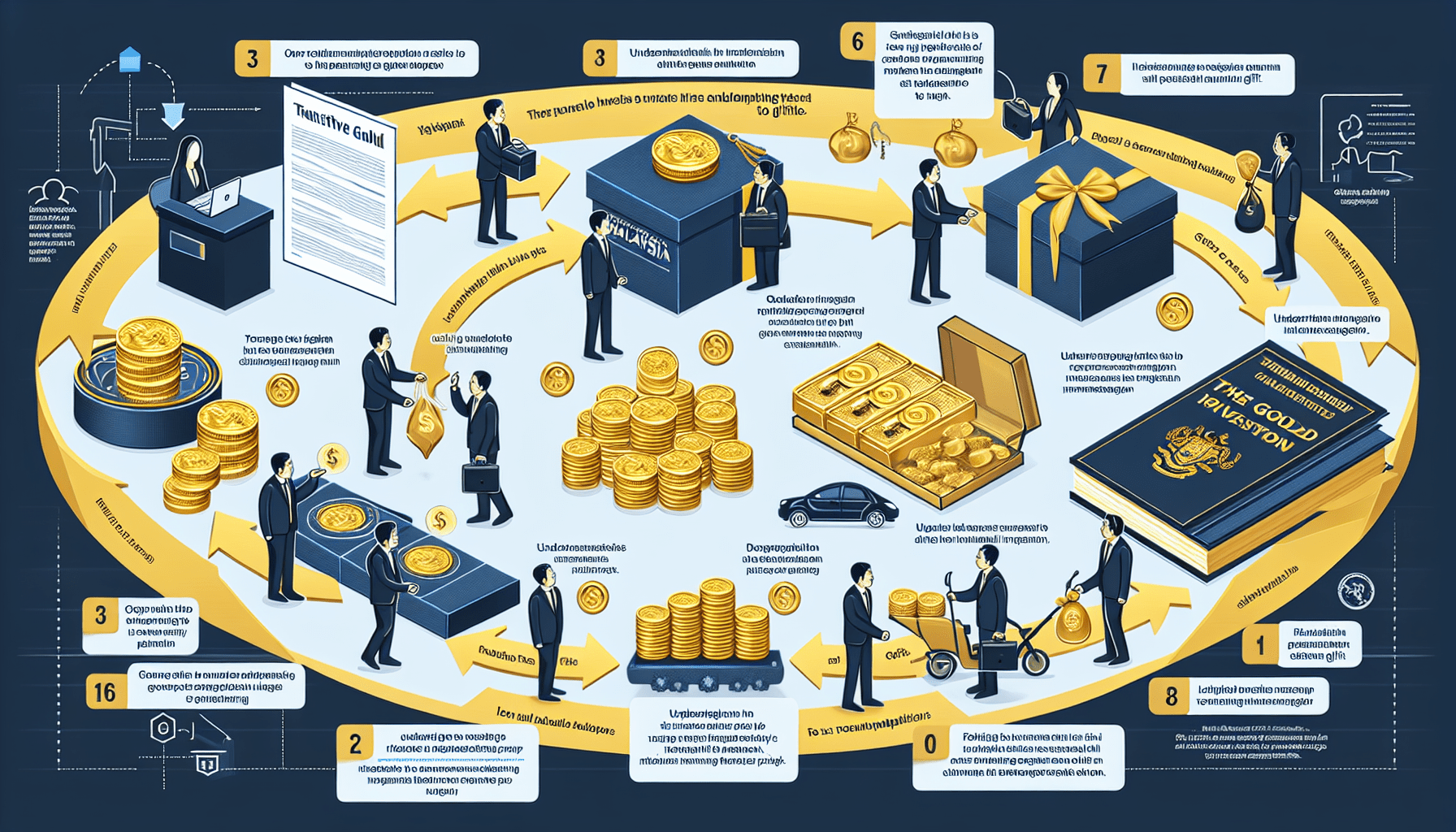

Process of transferring gold investment

The process of transferring gold investment as a gift in Malaysia can vary depending on the specific circumstances. However, here is a general outline of the steps involved:

Assess the current value of the gold investment: Determine the current market value of the gold investment to establish a fair transfer price.

Transfer ownership: Complete the necessary documentation to transfer ownership of the gold investment from the original owner to the recipient. This may involve filling out transfer forms and providing identification documents.

Secure storage: Ensure that the transferred gold investment is stored securely, either by the recipient or through a trusted storage facility.

Gift Taxes and Duties

Overview of gift taxes and duties in Malaysia

In Malaysia, gift taxes are generally not applicable. However, it is essential to consider any potential duties or taxes that may apply to the transfer of the gold investment. The Malaysian Inland Revenue Board (IRB) provides guidance on gift tax exemptions and thresholds.

Tax implications of transferring gold investment as a gift

While gift taxes may not be applicable, there may be potential tax implications for the recipient of the gold investment. The recipient should consult with a tax advisor to understand any potential tax obligations on the investment’s future gains or income.

Exemptions and thresholds for gift taxes

As mentioned earlier, gift taxes are generally not applicable in Malaysia. However, it is advisable to be aware of any exemptions or thresholds that may apply in specific situations. Consulting with a tax professional will ensure compliance with all relevant regulations.

Methods of Transferring Gold Investment

Direct transfer from the original owner to the recipient

The most straightforward method of transferring a gold investment as a gift is through a direct transfer of ownership from the original owner to the recipient. This involves completing the necessary documentation and ensuring the secure transfer of the physical gold or ownership rights.

Transferring gold investment through a trusted third party

Alternatively, transferring a gold investment through a trusted third party, such as a financial institution or gold dealer, can provide added security and convenience. The third party can facilitate the transfer of ownership and provide guidance throughout the process.

Utilizing digital platforms for transferring gold investment

With the growing popularity of digital platforms, it is now possible to transfer gold investment electronically. Some platforms allow users to buy and sell digital representations of gold, which can be transferred easily to the recipient. However, it is important to research and choose a reputable platform to ensure the security of the investment.

Safety and Security

Ensuring the safety and security of transferred gold investment

When transferring a gold investment as a gift, ensuring the safety and security of the transferred gold is of utmost importance. Whether utilizing secure storage facilities or holding the gold personally, measures should be taken to protect the investment from theft or damage.

Insurance coverage for transferred gold investment

Consider obtaining insurance coverage for the transferred gold investment to provide additional protection. Insurance policies for gold investment may cover risks such as theft, loss, or damage. It is advisable to discuss insurance options with a reputable insurance provider.

Secure storage options for gold investment

If the recipient chooses to store the transferred gold investment, various secure storage options are available. These may include safe deposit boxes at banks, private secure vaults, or reputable storage facilities dedicated to gold and precious metals. It is essential to choose a storage option that provides adequate security measures and peace of mind.

Considerations for the Recipient

Tax obligations for the recipient

As the recipient of a transferred gold investment, it is crucial to understand and comply with any tax obligations that may arise. This may include reporting the value of the investment for tax purposes or paying taxes on any eventual gains or income generated from the investment. Seeking advice from a tax professional will ensure compliance with tax regulations.

Managing the transferred gold investment

The recipient should carefully consider how to manage the transferred gold investment. This may include decisions regarding storage, monitoring market trends, and evaluating the investment’s performance. Regularly assessing the investment’s value and understanding the factors that influence it will help the recipient make informed decisions.

Selling or liquidating the transferred gold investment

At some point, the recipient may decide to sell or liquidate the transferred gold investment. It is important to consider potential costs, fees, and any tax implications associated with selling the investment. Understanding the current market conditions and seeking advice from a financial advisor can help optimize the selling process and maximize returns.

Alternatives to Transferring Gold Investment

Gifting gold jewelry instead of gold investment

If transferring a gold investment is not feasible or suitable, an alternative option is to gift gold jewelry. Gold jewelry holds sentimental value and can be a cherished gift for special occasions. While it may not offer the same investment benefits as gold bullion, it still retains an inherent value.

Investing in gold-related assets on behalf of the recipient

Another alternative is to invest in gold-related assets on behalf of the recipient. This may include purchasing shares of companies engaged in gold mining, investing in gold ETFs, or acquiring shares of mutual funds that include gold-related investments. These alternatives provide exposure to the gold industry without the need for physical ownership.

Providing financial education and guidance on gold investment

If the recipient is interested in gold investment but lacks knowledge or experience, an alternative approach is to provide financial education and guidance. This can involve sharing resources, recommending reputable sources of information, or connecting the recipient with a trusted financial advisor. By empowering the recipient with knowledge, they can make informed decisions regarding their investment journey.

Conclusion

Transferring a gold investment as a gift in Malaysia can be a meaningful and unique way to celebrate special occasions. Gold investment offers numerous benefits, including acting as a hedge against inflation, diversifying investment portfolios, and providing liquidity and tangibility. However, it is crucial to consider the legal and financial implications, as well as the recipient’s preferences and responsibilities. By understanding the process and exploring suitable alternatives, both the giver and recipient can ensure a successful and rewarding gold investment gift experience.