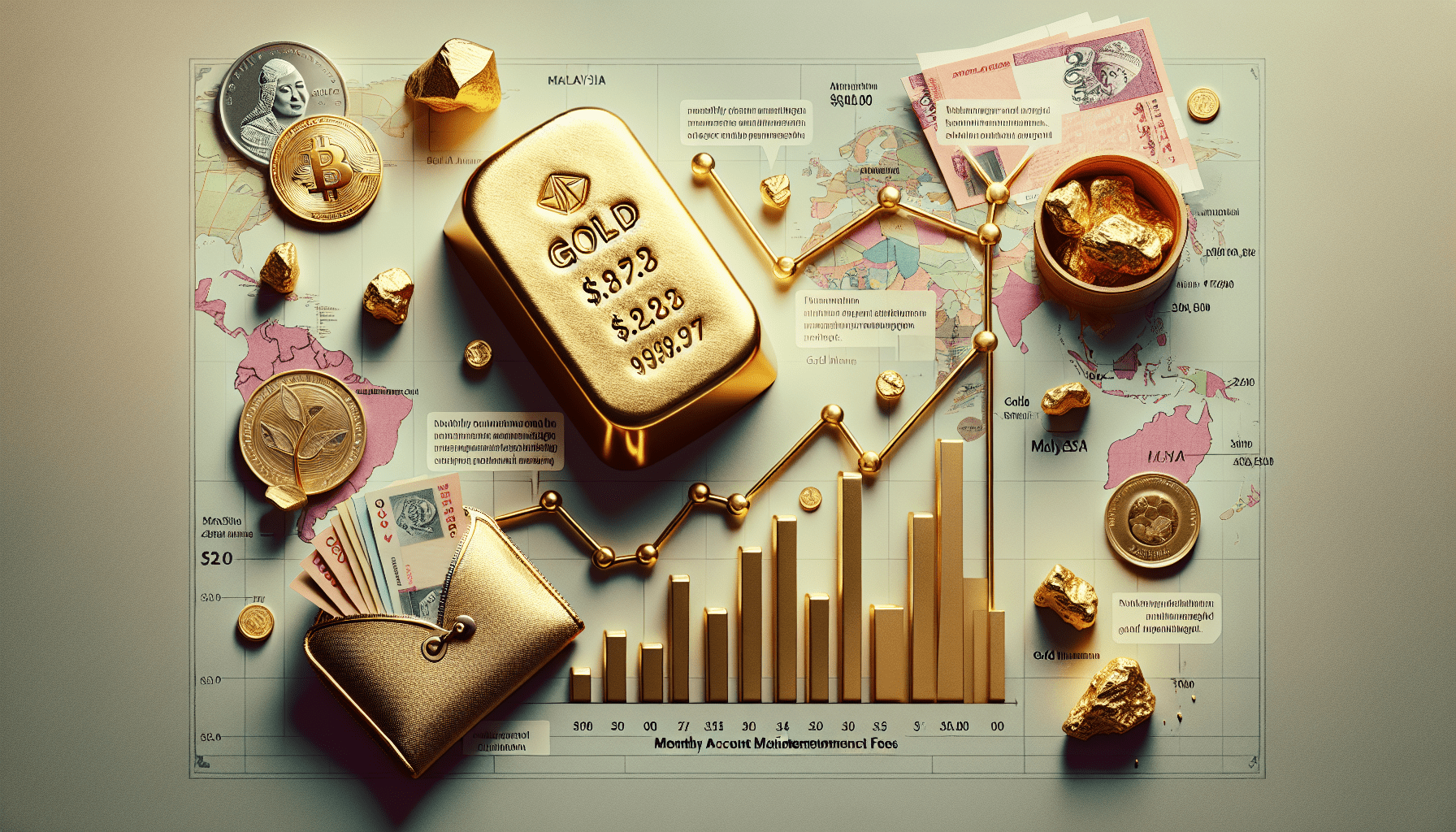

Are you considering investing in gold in Malaysia but worried about potential monthly account maintenance fees? Well, fret not! In this article, we will answer the burning question on every investor’s mind: Are there any monthly account maintenance fees for gold investment in Malaysia? We will delve into the details, providing you with all the information you need to make informed decisions about your gold investment. So, sit back, relax, and let’s explore the world of gold investment in Malaysia together!

What is gold investment?

Gold investment refers to the act of allocating funds to acquire and hold gold for the purpose of preserving and growing wealth. It is a popular investment option due to the enduring value of gold and its ability to act as a hedge against inflation and economic uncertainties. Gold investment can take various forms, including physical gold, gold savings accounts, gold exchange-traded funds (ETFs), and gold certificates.

Definition of gold investment

Gold investment entails the purchase and ownership of gold in its physical form or investment vehicles that represent gold ownership. It involves buying gold at the prevailing market price and holding it as a long-term investment. The value of gold may appreciate or depreciate over time, offering potential returns for investors.

Benefits of gold investment

Investing in gold offers several advantages. First, gold is considered a safe haven asset, providing protection against economic downturns and market volatility. This stability makes gold a reliable store of value. Second, gold has a low correlation with other financial assets like stocks and bonds, which can help diversify an investment portfolio and reduce risk. Finally, gold investment offers the potential for capital appreciation, as the price of gold tends to rise over the long term.

Types of gold investment in Malaysia

In Malaysia, individuals have several options for investing in gold. Each option has its own features and considerations, allowing investors to choose a method that aligns with their financial goals and risk appetite.

Physical gold investment

Investing in physical gold involves purchasing gold in the form of coins or bars and owning it outright. These physical assets can be stored at home or in a secure vault. Physical gold investment provides direct ownership and tangible possession of the precious metal.

Gold savings account

A gold savings account is a facility offered by banks where customers can deposit money to be converted into gold. The deposited amount is then credited to the account holder’s gold balance, which represents their ownership of gold. This method allows for convenient gold ownership without the need for physical storage.

Gold exchange-traded funds (ETFs)

Gold ETFs are investment funds that track the price of gold and trade on stock exchanges. These funds hold gold bullion or derivatives and provide investors with indirect ownership of the precious metal. Gold ETFs offer ease of buying and selling gold shares, making them a liquid investment option.

Gold certificates

Gold certificates are paper instruments issued by banks or financial institutions that represent ownership of a specified amount of gold. These certificates are transferrable and can be bought and sold in the market. They provide investors with a secure and convenient way to invest in gold without the need for physical storage.

Understanding account maintenance fees

Account maintenance fees are charges imposed by financial institutions or service providers for the ongoing maintenance and management of investment accounts. These fees are important to understand and consider, as they can impact the overall cost and returns of gold investment.

Definition of account maintenance fees

Account maintenance fees refer to the charges levied by financial institutions to cover the expenses associated with maintaining and servicing investment accounts. These fees are typically charged on a regular basis, such as monthly or annually, and contribute to the operational costs incurred by the service provider.

Purpose of account maintenance fees

Account maintenance fees are crucial for financial institutions to sustain the infrastructure and resources required to support investment accounts. These fees cover various expenses, including administrative costs, customer support, account statements, technology platforms, and regulatory compliance. By charging maintenance fees, service providers ensure that investors receive reliable and efficient account management services.

Account maintenance fees for physical gold investment

When investing in physical gold, it is important to consider the account maintenance fees associated with owning and storing the precious metal.

Storage and insurance fees

Physical gold requires secure storage to protect it from theft or damage. Storage facilities charge fees based on the weight and value of the gold being stored. Additionally, insurance fees are necessary to provide coverage against potential risks. These fees vary depending on the storage provider and the level of insurance coverage desired.

Transaction fees

Buying and selling physical gold may involve transaction fees, which are charges imposed by bullion dealers or brokers. These fees can include markups on the price of gold and commissions for facilitating the transactions. It is important to compare transaction fees across different providers to minimize costs.

Account maintenance fees for gold savings account

Gold savings accounts come with their own set of maintenance fees, which investors should be aware of.

Monthly maintenance fees

Some gold savings accounts may have monthly maintenance fees to cover the administrative and operational costs incurred by the bank. These fees are typically charged regardless of the account balance and should be considered when evaluating the overall cost of holding the gold savings account.

Transaction fees

Gold savings accounts may also impose transaction fees for activities such as depositing funds, converting money into gold, or withdrawing gold. These fees can vary depending on the bank and the type of transaction being performed.

Account maintenance fees for gold exchange-traded funds (ETFs)

Gold ETFs have their own account maintenance fees that investors need to take into account.

Management fees

Gold ETFs charge management fees to cover the costs of managing the fund, including administrative expenses, marketing, custodian fees, and operational costs. These fees are usually calculated as a percentage of the total assets under management and accrued on a daily or annual basis.

Brokerage fees

When buying or selling gold ETF shares, investors may incur brokerage fees imposed by stockbrokers or online trading platforms. These fees are typically charged for executing the trade and can vary depending on the broker and the trading volume.

Account maintenance fees for gold certificates

Investing in gold certificates also involves account maintenance fees that investors should be aware of.

Custodian fees

Gold certificates require custodians to store and manage the underlying gold. Custodian fees cover the costs associated with safekeeping the gold and maintaining the necessary documentation. These fees are typically charged on an annual basis and may vary depending on the quantity and value of the gold held.

Subscription fees

When purchasing gold certificates, investors may be required to pay subscription fees. These fees cover the administrative and processing costs involved in issuing the certificates. Subscription fees are usually a one-time charge, but they can vary depending on the issuing institution.

Redemption fees

When redeeming gold certificates for physical gold, investors may face redemption fees. These fees cover the costs associated with converting the certificates into physical gold and may vary depending on the quantity and form of gold being redeemed.

Comparing account maintenance fees across different gold investment options

To determine the most cost-effective gold investment option, it is essential to compare the account maintenance fees associated with each choice.

Cost-effectiveness analysis

When comparing fees, investors should consider not only the absolute amount charged but also the value and benefits offered by the investment option. For example, if a gold savings account charges higher maintenance fees but provides additional services such as online banking or customer support, it may still be more cost-effective compared to other options.

Factors to consider when comparing fees

Apart from the account maintenance fees, investors should take into account factors such as liquidity, convenience, security, and potential returns when evaluating different gold investment options. It is important to strike a balance between fees and the overall investment experience to make an informed decision.

Additional costs to consider for gold investment

In addition to account maintenance fees, there are other costs associated with gold investment that investors should be mindful of.

Spread or markup fees

When buying physical gold or gold ETFs, investors may encounter spread or markup fees. These fees are the difference between the buying and selling prices of the gold and are charged by bullion dealers or brokers. It is important to compare the spread fees across different providers to ensure competitive pricing.

Tax implications

Gold investment may have tax implications depending on the jurisdiction and the holding period. Investors should consult with tax professionals to understand the potential tax liabilities associated with their gold investments, such as capital gains taxes or wealth taxes.

Currency conversion fees

If investing in gold denominated in a currency different from the investor’s base currency, currency conversion fees may apply. These fees cover the costs of converting funds from one currency to another and can negatively impact the overall returns of the investment. It is advisable to consider currency conversion fees when choosing gold investment options.

Tips to minimize account maintenance fees for gold investment

To minimize account maintenance fees and make gold investment more cost-effective, consider the following tips:

Research and compare different providers

Take the time to research and compare the account maintenance fees charged by different providers. Look for reputable institutions that offer competitive fees without compromising on security and customer support. Consider the overall value provided by each provider to ensure a satisfactory investment experience.

Opt for lower-cost investment options

Examine the fee structures of various gold investment options and choose those with lower account maintenance fees. For example, investing in gold ETFs may be more cost-effective in terms of management fees compared to maintaining physical gold or gold savings accounts.

Be mindful of transaction frequency

Frequent transactions, such as buying or selling gold, can accumulate transaction fees over time. To minimize these costs, consider a buy-and-hold strategy or reduce the frequency of transactions. By adopting a long-term investment approach, investors can minimize the impact of transaction fees on their overall gold investment.

In conclusion, gold investment in Malaysia offers various options for investors seeking to diversify their portfolios and hedge against economic uncertainties. Understanding the account maintenance fees associated with each gold investment option is essential to make informed investment decisions. By considering the different fees, additional costs, and implementing cost-saving strategies, investors can navigate the gold investment landscape more effectively while maximizing their potential returns.