Curious about the future value of gold? Wondering what its worth will be in the next five years? If you’re an expert in gold investment or simply interested in exploring the possibilities, this article is for you. We’ll dive into the topic of gold’s future value, providing you with a comprehensive analysis that covers various perspectives and factors influencing this precious metal. By the end, you’ll have a clearer understanding of what the future may hold for gold and its potential worth five years down the line. So, let’s embark on this fascinating journey together!

Introduction to Gold Investment

Investing in gold has long been recognized as a prudent and reliable way to preserve and grow wealth. For centuries, gold has stood the test of time as a valuable and sought-after asset. Whether it’s jewelry, coins, or bars, gold has captivated the human imagination and has been revered as a symbol of wealth and prosperity.

Why invest in gold?

There are several compelling reasons to invest in gold. Firstly, gold serves as a hedge against inflation. In times of rising prices and economic uncertainties, gold has historically retained its value, providing a safe haven for investors. Additionally, gold has a low correlation with other assets, such as stocks and bonds, making it an effective diversification tool. By including gold in your investment portfolio, you can reduce overall risk and potentially enhance returns.

Historical performance of gold

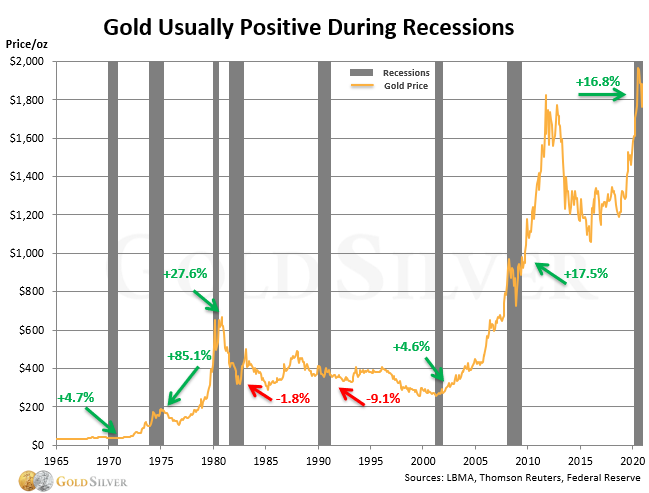

Gold has a remarkable track record of performance over the years. From ancient civilizations to the modern era, the value of gold has consistently risen. In the past few decades, gold has delivered impressive returns, especially during times of economic turbulence. For example, during the 2008 financial crisis, while stocks plummeted, gold soared, proving its resilience and ability to safeguard wealth.

Factors influencing the price of gold

The price of gold is influenced by several factors, both economic and geopolitical. One of the key drivers is the overall demand and supply dynamics. When demand for gold outstrips supply, prices tend to rise, and vice versa. Other factors include interest rates, inflation, currency devaluation, stock market performance, and geopolitical tensions. Understanding these factors can help investors make informed decisions about when to buy or sell gold.

Current Gold Market Outlook

Current gold price

As of [current date], the price of gold stands at [current price per ounce]. The price of gold is subject to daily fluctuations based on market demand and supply. It is important to note that gold is traded internationally, and the price can vary slightly in different regions.

Recent trends and forecasts

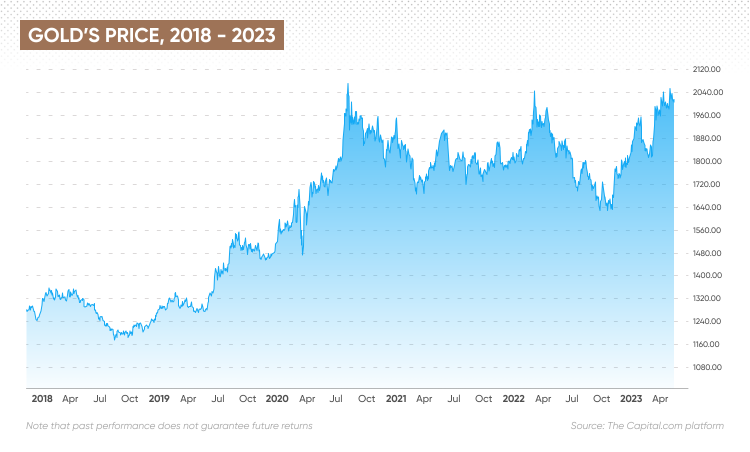

In recent years, gold prices have experienced significant volatility. In [recent years], we have seen both sharp increases and declines in the price of gold. Factors such as economic indicators, political developments, and global events can impact short-term price movements. However, the long-term trend for gold remains positive, with many experts predicting steady growth in the coming years.

Market sentiments and investor behavior

Market sentiments and investor behavior play a crucial role in shaping the gold market outlook. During times of economic uncertainty or geopolitical tensions, investors tend to flock to safe-haven assets like gold. This increased demand can drive up prices. Conversely, when the economy is booming and investor confidence is high, there may be a decrease in gold demand. Understanding market sentiments and investor behavior can provide valuable insights into future gold price movements.

Factors Affecting Future Gold Prices

Economic factors

Economic factors, such as GDP growth, inflation rates, and interest rates, have a significant impact on the price of gold. In times of economic expansion, demand for gold jewelry and luxury goods tends to increase, which can drive up prices. Conversely, during economic downturns, investors may turn to gold as a safe investment, leading to a surge in demand and rising prices.

Geopolitical factors

Geopolitical factors, including political instability, trade disputes, and wars, can significantly influence the price of gold. When geopolitical tensions escalate, investors seek refuge in gold as a store of value. The perceived safety and stability of gold during uncertain times can drive up demand and push prices higher.

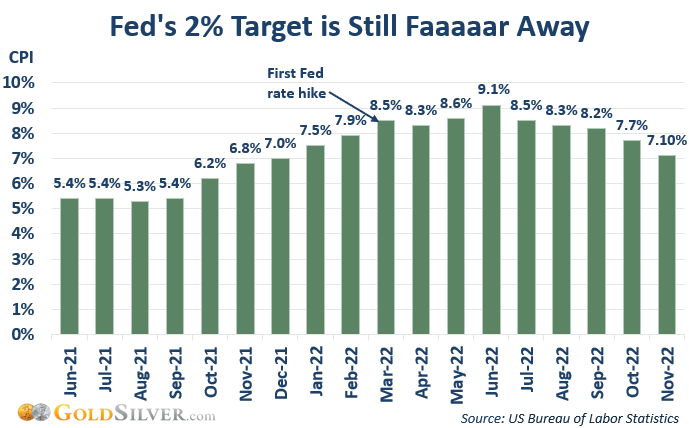

Inflation and currency devaluation

Gold has historically been viewed as a hedge against inflation and currency devaluation. When the value of a currency declines or inflation erodes purchasing power, gold retains its value, making it an attractive investment. The prospect of rising inflation or currency devaluation can drive investors to allocate a portion of their portfolio to gold, thereby increasing demand and potentially impacting prices.

Interest rates

Interest rates can have a profound effect on the price of gold. When interest rates are low, the opportunity cost of holding gold decreases, as there are fewer attractive alternatives for investment. This can result in increased demand for gold and upward pressure on prices. Conversely, when interest rates rise, the cost of holding gold increases, which can dampen demand and potentially lead to lower prices.

Stock market performance

The performance of the stock market can influence gold prices. In times of stock market volatility or downturns, investors often seek safe-haven assets like gold. The negative correlation between gold and stocks makes it an appealing option for diversification. As such, a decline in stock prices can lead to increased demand for gold and upward price movements.

Demand and supply dynamics

The balance between demand and supply is a fundamental determinant of gold prices. Gold demand is driven by various factors, including jewelry purchases, industrial uses, central bank purchases, and investor sentiment. Additionally, the supply of gold is influenced by mining production, recycling, and central bank sales. Fluctuations in demand and supply can impact the price of gold, as shifts in either direction can create imbalances.

Expert Predictions and Forecasts

Views from prominent economists

Prominent economists have varied perspectives on the future price of gold. Some believe that the current economic and geopolitical uncertainties will drive the price of gold higher in the coming years. Others argue that the global economy is becoming more stable, which could lead to a decrease in gold demand and prices. It is essential to consider multiple viewpoints and conduct thorough research when evaluating expert predictions.

Financial institution forecasts

Financial institutions often provide forecasts on the price of gold based on their extensive research and analysis. These forecasts can be valuable indicators of the market outlook. However, it is crucial to approach these forecasts with caution, as they are subject to change based on evolving economic and geopolitical circumstances.

Analyst opinions

Industry analysts closely monitor and analyze the gold market to provide insights and opinions on future price movements. These opinions consider factors such as supply and demand dynamics, macroeconomic trends, and market sentiment. While analyst opinions can provide valuable perspectives, it is important to conduct independent research and consider a range of sources before making investment decisions.

Gold Price History Analysis

Trends in previous 5-year periods

Analyzing the price trends of gold over the past five years can provide valuable insights into its potential future performance. By studying historical data, investors can identify patterns, understand price volatility, and evaluate the overall market conditions. Historical analysis can help investors make informed decisions and set realistic expectations regarding the future price of gold.

Comparison with other investment options

When considering investing in gold, it is essential to assess its performance compared to other investment options. By comparing gold’s historical returns, risks, and correlations with other assets, investors can make informed decisions about asset allocation and diversification strategies. Understanding how gold performs relative to stocks, bonds, and other commodities can provide valuable context for investment decisions.

Future Economic and Political Trends

Global economic outlook

The global economic outlook plays a crucial role in shaping the price of gold. Factors such as GDP growth, trade policies, and monetary policies of major economies can impact gold demand and prices. Evaluating macroeconomic indicators and staying updated on economic trends can help investors anticipate potential future price movements.

Impact of major political events

Major political events, such as elections, policy changes, and geopolitical conflicts, can have significant ramifications for gold prices. Political uncertainty and instability often drive up demand for gold as investors seek safe-haven assets. By closely monitoring political developments, investors can gain insights into the potential impact on gold prices.

Trade policies and agreements

Trade policies and agreements between countries can influence the price of gold. Changes in tariffs, trade disputes, or the signing of trade agreements can have ripple effects on global economic stability. Investors should keep a close eye on trade policies and agreements as they can impact currencies, inflation rates, and investor sentiment, all of which can impact the price of gold.

Emerging Markets and Gold Demand

Rise of emerging economies

The rise of emerging economies, such as China and India, has led to increased demand for gold. As these economies continue to grow, so does their middle class, leading to greater disposable incomes and higher demand for luxury goods, including gold jewelry. Understanding the dynamics of emerging markets and their impact on gold demand can provide valuable insights into future price trends.

Changing consumer behavior

Consumer behavior towards gold has evolved over the years. While jewelry remains a significant driver of gold demand, there is a growing interest in investment-grade gold products, such as bars and coins. Additionally, changing consumer preferences, such as the rise of sustainable and ethically-sourced gold, can influence demand patterns and potentially impact prices.

Central bank gold purchases

Central banks around the world have been actively increasing their gold reserves in recent years. These purchases serve as a vote of confidence in the long-term value and stability of gold. By closely monitoring central bank actions, investors can gain insights into the demand dynamics of gold and potentially anticipate price movements.

Technological Advancements and Gold

Impact of technology on gold mining

Technological advancements have revolutionized the gold mining industry, making extraction more efficient and cost-effective. Innovations such as remote sensing, drones, and advanced machinery have improved productivity and reduced environmental impact. Understanding the impact of technology on gold mining can provide insights into the future supply dynamics and potential effects on gold prices.

Growing applications of gold in industries

Gold has a wide range of industrial applications, including electronics, medicine, and luxury goods. The growing demand for smartphones, renewable energy technologies, and medical devices has increased the need for gold. By assessing industry trends and understanding the evolving applications of gold, investors can gain insights into potential future demand patterns.

Potential future developments

The future of gold is closely tied to technological advancements and innovations. Research and development efforts are focused on exploring new uses for gold, such as in nanotechnology and biomedicine. As new applications emerge, the demand for gold may increase, potentially impacting prices. Keeping abreast of the latest technological developments can provide valuable insights for investors.

Investment Strategies for Gold

Long-term vs. short-term investment

Investors have different investment horizons and objectives when it comes to gold. Some opt for long-term investment strategies, considering gold as a store of value and a hedge against inflation. Others engage in short-term trading, taking advantage of price volatility. Understanding and aligning your investment strategy with your financial goals and risk tolerance is essential when investing in gold.

Diversification with gold

Diversification is a crucial element of any investment portfolio. By including gold in your portfolio, you can reduce risk through asset diversification. Gold’s low correlation with other assets, such as stocks and bonds, makes it an effective diversification tool. Including an appropriate allocation of gold can help balance risk and potentially enhance overall portfolio returns.

ETFs and gold stocks

Exchange-traded funds (ETFs) and gold mining stocks provide alternative ways to invest in gold. Gold ETFs allow investors to own fractional shares of physical gold, providing liquidity and ease of trading. Gold mining stocks enable investors to participate in the potential upside of gold mining operations. It is important to conduct thorough research and consider the risks associated with these investment options.

Physical gold vs. paper gold

Investors have the option to invest in physical gold, such as bars or coins, or paper gold, such as gold certificates or futures contracts. Physical gold offers the advantage of tangible ownership and can be stored securely. Paper gold provides convenience and liquidity, but it may not offer the same level of security as physical ownership. Assessing the advantages and disadvantages of each option is crucial when considering investment strategies.

Risk management strategies

Investing in gold, like any other investment, involves risks. It is important to consider risk management strategies to protect your investment. Setting clear investment goals, diversifying your portfolio, and conducting thorough research are essential steps. Additionally, monitoring market trends, staying updated on economic and geopolitical developments, and consulting with financial professionals can help mitigate risks associated with gold investment.

Conclusion

Gold investment offers a variety of benefits, both as a potential store of value and a tool for portfolio diversification. Understanding the historical performance of gold, factors influencing its price, and expert predictions can provide valuable insights for investors. However, it is important to recognize the uncertainties inherent in the market and the importance of due diligence in making informed investment decisions. By carefully considering the long-term value of gold and incorporating it into a well-balanced investment strategy, investors can position themselves for potential growth and wealth preservation.