Are you curious about the current trends in gold investment among Malaysians? In this article, we will explore the fascinating world of gold investment and shed light on the growing popularity of this precious metal among Malaysians. From the reasons behind the surge in gold investments to the various strategies employed by Malaysians, we will delve into the details and provide you with a comprehensive understanding of the trends in gold investment. So, grab a cup of coffee and get ready to immerse yourself in the captivating world of gold investment in Malaysia.

Demand for Gold Investment

Increasing interest in gold investment

Gold investment has become increasingly popular among Malaysians in recent years. This surge in interest can be attributed to various factors, including economic uncertainties, the desire for financial security, and the potential for high returns on investment. As people seek alternative forms of investment to diversify their portfolios, gold has emerged as a favorable option due to its unique properties and historical value.

Rising demand for physical gold

One notable trend in gold investment among Malaysians is the growing demand for physical gold. Many individuals choose to invest in gold bars and coins as a tangible asset that they can hold and store themselves. This preference for physical gold is driven by a sense of security and control, as investors have direct ownership of the precious metal and can easily access it whenever needed.

Growing demand for gold jewelry

Another significant trend is the increasing demand for gold jewelry as an investment. Malaysians have a long-standing cultural affinity for gold jewelry, often purchasing it as a symbol of wealth and prosperity. However, in recent years, there has been a shift in mindset, with more people recognizing the investment potential of gold jewelry. This trend is particularly evident among the younger generation, who view gold jewelry not only as a fashion accessory but also as a valuable asset that can appreciate over time.

Shift towards gold as an inflation hedge

Inflation and the erosion of purchasing power are significant concerns for investors. As a result, there has been a noticeable shift towards gold as an inflation hedge among Malaysians. Gold has historically proven to maintain its value during periods of inflation, making it an attractive option for safeguarding wealth and preserving purchasing power. This trend is particularly evident during times of economic uncertainty, such as the global financial crisis or the ongoing COVID-19 pandemic, where investors seek the stability and protection that gold offers.

Types of Gold Investments

Gold bars and coins

One of the most traditional forms of gold investment is through the purchase of gold bars and coins. These physical assets provide investors with direct ownership of the precious metal. Gold bars are typically available in various weights, ranging from small bars suitable for individual investors to larger bars favored by institutional investors. Gold coins, on the other hand, often carry both intrinsic and collector value, making them popular among numismatic enthusiasts.

Gold jewelry

Gold jewelry has long been a popular investment choice among Malaysians due to its cultural significance and aesthetic appeal. Investing in gold jewelry allows individuals to combine the dual benefits of owning a valuable asset and enjoying its beauty. However, it is essential to note that investing in gold jewelry differs from investing in pure gold as the value of jewelry is influenced by its design, craftsmanship, and market demand for specific styles.

Gold exchange-traded funds (ETFs)

For investors seeking exposure to gold without the need for physical ownership, gold exchange-traded funds (ETFs) offer a convenient option. ETFs are investment funds that trade on stock exchanges and aim to track the price of gold. By investing in gold ETFs, individuals can gain indirect exposure to the price movements of the precious metal without the costs and logistical considerations associated with physical gold ownership.

Gold mining stocks

investing in gold mining stocks is another way to gain exposure to the gold industry. By purchasing shares of gold mining companies, investors can benefit from potential capital appreciation if the value of gold increases. However, it is important to consider the risks associated with mining stocks, such as operational challenges, regulatory issues, and fluctuations in gold prices.

Factors Influencing Gold Investment

Economic and political uncertainties

Economic and political uncertainties have a significant impact on the demand for gold investment. During times of economic instability or geopolitical tensions, investors often seek refuge in gold as a safe haven asset. This is because gold has a long-standing reputation as a store of value that can withstand economic downturns and geopolitical risks. As a result, any increase in economic or political uncertainties tends to drive up demand for gold investment.

Currency fluctuations

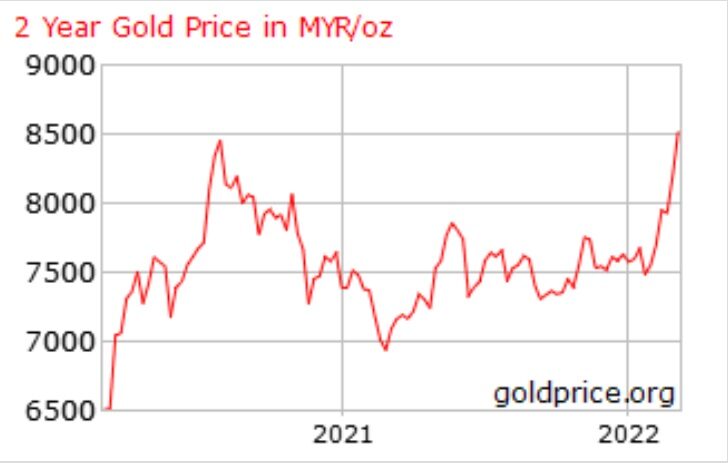

Currency fluctuations play a crucial role in determining the attractiveness of gold as an investment option. When a country’s currency depreciates, the price of gold in that currency typically rises, making it more appealing to investors. This relationship is particularly significant for Malaysians, as the value of the Malaysian Ringgit is subject to fluctuations in global currency markets. Therefore, the ups and downs of currency exchange rates can significantly influence the demand for gold investment in Malaysia.

Inflation and purchasing power

Inflation erodes the purchasing power of a currency, reducing the value of money over time. As a result, investors often turn to gold as a hedge against inflation. Gold has historically demonstrated the ability to preserve its value during periods of high inflation, making it an attractive long-term investment option. In Malaysia, where inflation rates can fluctuate, individuals may choose to invest in gold to protect their wealth and maintain their purchasing power.

Interest rates and opportunity cost

The prevailing interest rates in an economy influence the opportunity cost of investing in gold. When interest rates are low, the opportunity cost of holding gold decreases, making it more attractive as an investment option. Conversely, when interest rates are high, investing in gold becomes relatively less attractive compared to other investments that generate income. Therefore, fluctuations in interest rates can impact the demand for gold investment among Malaysians.

Government Regulations and Taxation

Laws and regulations for gold investment

Governments often implement specific laws and regulations to ensure the proper functioning of the gold market and protect investors. In Malaysia, the gold investment sector is regulated by authorities such as Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These regulatory bodies establish rules and guidelines to govern the buying, selling, and trading of gold, ensuring transparency, fairness, and investor protection.

Import and export restrictions

Countries may impose import and export restrictions on gold to regulate its supply and protect domestic industries. These restrictions can affect the availability and pricing of gold in the market. In Malaysia, the import and export of gold are subject to certain guidelines and requirements, including the need for relevant permits. Investors must be aware of these restrictions when engaging in cross-border gold transactions.

Taxation on gold investment

Taxation policies vary across jurisdictions when it comes to gold investment. In Malaysia, gold investment is generally exempt from goods and services tax (GST). However, it is crucial to stay informed about any changes in tax regulations that may have an impact on gold investment, as taxation policies can significantly influence the overall profitability and attractiveness of investing in gold.

Investment Strategies for Gold

Long-term investment approach

Many experts recommend taking a long-term investment approach when investing in gold. Given its historical value and potential for price appreciation, gold is often seen as a suitable asset for wealth preservation and long-term capital growth. Investors who adopt a long-term perspective understand that short-term fluctuations in gold prices are to be expected and focus on the overall upward trend over time.

Diversification with gold

Diversification is a key strategy for managing investment risk, and gold can play a significant role in diversifying an investment portfolio. By allocating a portion of one’s portfolio to gold, investors can reduce the overall risk exposure to other assets such as stocks and bonds. Gold has shown a negative correlation with several other asset classes, meaning that it tends to perform well when other investments may be experiencing downturns.

Timing the gold market

Timing the gold market refers to the practice of buying and selling gold based on short-term price movements. While some investors may try to predict short-term price fluctuations to maximize their returns, timing the gold market can be challenging and risky. Market timing requires careful analysis of various factors, including economic indicators, political developments, and market sentiment – factors that can be difficult to predict accurately.

Investing in gold mining stocks

Investing in gold mining stocks allows individuals to gain exposure to the gold industry beyond physical gold ownership. However, it is important to note that investing in mining stocks carries its own set of risks. Factors such as operational challenges, regulatory compliance, and company-specific issues can impact the performance of mining stocks. Investors should carefully research and analyze individual mining companies before making investment decisions.

Role of Gold in Portfolios

Portfolio diversification benefits

One of the primary roles of gold in portfolios is its diversification benefits. Gold has a unique characteristic of being a non-correlated or negatively correlated asset to other traditional investments such as stocks and bonds. This means that gold tends to perform well when other investments may be experiencing downturns. By adding gold to a portfolio, investors can reduce the overall volatility and enhance the risk-adjusted returns.

Gold as a safe haven asset

Gold has long been recognized as a safe haven asset, meaning it tends to retain its value or even appreciate during times of economic uncertainty and market turmoil. This is because gold is not directly influenced by economic indicators or the performance of specific companies. When investors are worried about the stability of the financial markets or the global economy, they often turn to gold as a safe haven asset.

Gold’s negative correlation with other assets

Gold has demonstrated a negative correlation with certain asset classes, such as stocks and bonds. This means that when stocks and bonds are experiencing a decline in value, gold may rise in price or at least hold its value. This negative correlation can help offset potential losses during market downturns, making gold an attractive addition to a diversified investment portfolio.

Protecting against inflation and currency devaluation

Gold has a long-established reputation for protecting against inflation and currency devaluation. When inflation rises, the value of fiat currencies declines, making it more difficult for individuals to maintain their purchasing power. Gold, on the other hand, has historically proven to retain its value and even appreciate during periods of high inflation. By including gold in their portfolios, investors can mitigate the impact of inflation and safeguard their wealth.

Challenges of Gold Investment

Price volatility and market fluctuations

One of the challenges associated with gold investment is its price volatility and the unpredictability of market fluctuations. Gold prices can experience significant swings in short periods, influenced by various factors such as economic data, geopolitical events, and investor sentiment. This volatility poses challenges for investors who may find it difficult to time their entry and exit points in the market.

Storage and security of physical gold

For individuals who choose to invest in physical gold, the storage and security of the precious metal can present challenges. Proper storage measures need to be in place to protect the gold from theft, damage, or loss. Many investors opt for secure vaults or safety deposit boxes provided by financial institutions or specialized companies to ensure the safety of their gold holdings.

Ensuring authenticity of gold purchases

When investing in physical gold, there is always a risk of purchasing counterfeit or substandard gold products. It is essential for investors to verify the authenticity and purity of gold before making a purchase. Reputable dealers, who are certified by relevant authorities, can help mitigate this risk by providing authentic and certified gold products. Conducting thorough research and dealing with trusted sellers is crucial to ensure that the gold purchased is genuine.

Limited liquidity for certain gold investments

While gold is generally considered a liquid asset, certain forms of gold investment may have limited liquidity. For example, rare or collectible gold coins may have a smaller market, making it challenging to buy or sell them quickly. Investors should carefully consider the liquidity of their chosen gold investments and ensure that they have a clear exit strategy in case they need to sell their holdings promptly.

Current Market Trends

Increasing popularity of gold ETFs

Gold exchange-traded funds (ETFs) have gained significant popularity among Malaysian investors in recent years. These investment vehicles offer a convenient and cost-effective way to gain exposure to the price of gold without the need for physical ownership. Gold ETFs provide investors with flexibility and liquidity, as they can be bought and sold on stock exchanges similar to stocks. The ease of trading and potential for diversification have made gold ETFs an appealing choice for many Malaysians.

Rise in online gold trading platforms

The advent of technology has revolutionized the gold investment landscape, with the rise of online gold trading platforms. These platforms provide individuals with the opportunity to buy and sell gold conveniently from the comfort of their homes. Online gold trading platforms offer features such as real-time pricing, secure transactions, and access to a wide range of gold products. The ease of use and accessibility of online platforms have contributed to the growing interest in gold investment among Malaysians.

Growing interest in gold-backed digital currencies

Another emerging trend in gold investment is the growing interest in gold-backed digital currencies or stablecoins. These cryptocurrencies are typically pegged to the value of physical gold, providing investors with a digital representation of the precious metal. Gold-backed digital currencies combine the benefits of cryptocurrencies, such as ease of transfer and global accessibility, with the stability and value retention of gold. As the digital currency ecosystem continues to evolve, gold-backed digital currencies are poised to attract attention from Malaysian investors.

Influence of social media on gold investment trends

Social media platforms have become influential in shaping investment trends, and gold investment is no exception. Individuals often turn to social media platforms to gain insights, share experiences, and learn from experts in the field. Communities and forums dedicated to gold investment provide a platform for enthusiasts to discuss market trends, investment strategies, and potential opportunities. The influence of social media on gold investment trends among Malaysians cannot be overlooked, as it plays a significant role in disseminating information and shaping investment decisions.

Gold Investment Tips for Malaysians

Research and understand gold market fundamentals

Before venturing into gold investment, it is crucial for Malaysians to conduct thorough research and develop a solid understanding of the gold market fundamentals. This includes learning about factors that influence gold prices, understanding the various forms of gold investment available, and staying up-to-date with market news and trends. By equipping themselves with knowledge, investors can make informed decisions and maximize their chances of success.

Consult with reputable gold dealers or financial advisors

Seeking guidance from reputable gold dealers or financial advisors can provide valuable insights and expertise in navigating the gold investment landscape. These professionals can offer advice on suitable investment options, provide information on market trends, and assist with the purchase and sale of gold. Working with trusted professionals ensures that Malaysians receive accurate information and guidance tailored to their investment goals and risk appetite.

Consider cost-effective storage options

For those investing in physical gold, it is essential to consider cost-effective storage options. Storing gold in secure vaults or safety deposit boxes provided by financial institutions or specialized companies can provide peace of mind knowing that the precious metal is adequately protected. It is important to compare storage costs and ensure that the chosen storage facility meets the necessary security standards while remaining affordable.

Stay updated with market news and trends

Gold investment is a dynamic market that is influenced by a multitude of factors. Malaysians interested in gold investment should stay updated with market news and trends to make informed decisions. Keeping track of economic indicators, global events, and geopolitical developments can provide valuable insights into potential price movements and investment opportunities. By staying informed, investors can adapt their strategies and make timely investment decisions.

Outlook for Gold Investment in Malaysia

Predictions for future gold prices

While it is impossible to predict the future with certainty, experts and market analysts often provide predictions about future gold prices based on various factors. These predictions serve as guidance for investors but should be approached with caution. Factors influencing future gold prices in Malaysia may include economic trends, political stability, global demand, and supply dynamics. Monitoring these factors can help investors gain insights into potential long-term trends in gold investment.

Factors driving gold investment in Malaysia

Several factors are likely to continue driving gold investment in Malaysia. Economic uncertainties, geopolitical risks, inflationary pressures, and currency fluctuations are some of the key drivers that influence demand for gold as a safe haven and a hedge against uncertainty. Additionally, cultural affinity towards gold and the growing interest in alternative investments contribute to the continued appeal of gold investment among Malaysians.

Market expectations and expert opinions

Market expectations and expert opinions play a significant role in shaping the outlook for gold investment in Malaysia. Regular market analyses, reports, and commentaries from financial institutions, research firms, and industry experts provide valuable insights into the current state of the gold market and the anticipated future trends. Investors can leverage these insights to gauge market sentiment, evaluate risks, and make informed investment decisions.

Role of gold in the Malaysian economy

Gold holds considerable significance in the Malaysian economy beyond its role as an investment asset. The gold industry contributes to the country’s economy through activities such as gold mining, refining, jewelry manufacturing, and exports. The government and regulatory bodies play a crucial role in ensuring the smooth functioning of the gold market, supporting local industry players, and maintaining the integrity of gold-related transactions. Understanding the broader economic impact of gold investment can provide Malaysians with a holistic perspective on its role within the nation’s economy.