Thinking about investing in gold in Malaysia for the long term? Curious about the potential returns? Look no further, because this article will provide you with all the information you need. As a fund manager and gold investment expert, I’ll guide you through the ins and outs of investing in gold in Malaysia, giving you a clear understanding of the potential returns you can expect. From the basics of gold investment to the factors influencing its value, we’ll cover it all in a friendly and informative manner. So sit back, relax, and let’s explore the potential returns for long-term gold investments in Malaysia.

Understanding Gold Investments

What is gold?

Gold is a precious metal that has been valued for thousands of years. It is highly sought after for its beauty, rarity, and durability. Gold is often used in the production of jewelry, coins, and bullion. It is also considered a store of value and a hedge against economic uncertainties.

Why invest in gold?

Investing in gold can offer several benefits. Gold has historically been considered a safe haven asset, meaning its value tends to hold up well during times of economic uncertainty. It can act as a hedge against inflation and currency devaluation, providing protection for your wealth. Additionally, Gold Investments can diversify your portfolio, reducing overall risk.

Different investment options for gold

There are various ways to Invest in gold, depending on your preferences and goals. Physical gold, such as bars, coins, and jewelry, allows you to own tangible assets. Gold exchange-traded funds (ETFs) provide an opportunity to invest in gold without physically owning it. Gold mining stocks and mutual funds offer exposure to the gold mining industry. Finally, gold futures and options allow for trading of gold prices on futures exchanges.

Factors Affecting Gold’s Long-term Performance

Global economic conditions

Global economic conditions play a significant role in the performance of gold. When the economy is facing uncertainties, such as recessions or financial crises, investors often turn to gold as a safe haven asset. In times of stability and economic growth, however, the demand for gold may decrease.

Inflation and currency devaluation

Inflation and currency devaluation can erode the purchasing power of fiat currencies. As these currencies lose value, investors seek assets that can preserve their wealth, such as gold. Gold has historically held its value against inflation and currency devaluation, making it an attractive investment during such periods.

Geopolitical tensions

Geopolitical tensions, such as conflicts or political instability, can have a significant impact on the price of gold. When geopolitical risks rise, investors often turn to gold as a safe haven, driving up its demand and price. Conversely, when tensions ease, the demand for gold may decrease.

Interest rates and monetary policies

Changes in interest rates and monetary policies can influence the price of gold. When interest rates are low, the opportunity cost of holding gold decreases, making gold more attractive. Additionally, expansionary monetary policies, such as quantitative easing, can increase the supply of money, potentially leading to inflation and driving up the price of gold.

Historical Performance of Gold in Malaysia

Overview of gold market in Malaysia

The gold market in Malaysia is relatively developed, with various options for buying and selling gold. Malaysians have a strong cultural affinity for gold, often viewing it as a symbol of wealth and prosperity. There are several reputable gold dealers and jewelers throughout the country.

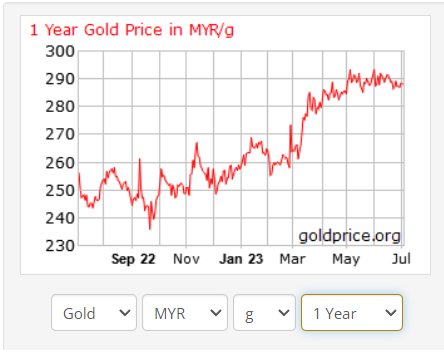

Historical gold price trends

Over the past few decades, the price of gold in Malaysia has experienced significant fluctuations. From the early 2000s to 2011, gold prices steadily increased, reaching an all-time high. However, from 2011 to 2015, gold prices declined, reflecting a period of relatively stable economic conditions. Since then, gold prices have remained relatively volatile.

Comparison with other investment assets

When comparing gold with other investment assets in Malaysia, it is important to consider factors such as returns, risks, and liquidity. While gold has provided strong returns over certain periods, it may not always outperform other assets, such as stocks or real estate. It is crucial to diversify investments and consider individual risk tolerance and investment goals.

Advantages of Long-term Gold Investments

Diversification of investment portfolio

One advantage of long-term gold investments is that they can diversify your investment portfolio. By allocating a portion of your assets to gold, you can potentially reduce risk and volatility. Gold has historically had a low correlation with other assets, such as stocks and bonds, making it a valuable addition to a diversified portfolio.

Hedge against inflation and economic downturns

Gold can be an effective hedge against inflation and economic downturns. During periods of high inflation, the value of fiat currencies may decline, while the price of gold tends to rise. Similarly, during economic downturns, when stock markets and other assets may experience significant declines, gold can provide stability and preserve wealth.

Store of value and wealth preservation

Gold has long been regarded as a store of value and a means of preserving wealth. Unlike fiat currencies, gold is not subject to management by central banks or governments. It is a tangible asset that can retain its value over time, making it an appealing option for those seeking to protect their wealth.

Liquidity and ease of transactions

Gold investments offer liquidity and ease of transactions. Physical gold can be easily bought and sold through reputable dealers and jewelers. Additionally, gold ETFs and other investment vehicles provide investors with the ability to trade gold on various exchanges. This liquidity enables investors to access their funds quickly when needed.

Risks and Challenges in Gold Investments

Market volatility and price fluctuations

Gold investments can be subject to market volatility and price fluctuations. The price of gold is influenced by various factors, such as economic conditions, geopolitical tensions, and investor sentiment. As a result, the value of gold can fluctuate significantly, potentially resulting in gains or losses for investors.

Potential impact of government regulations

Government regulations can impact the gold market and investments. Changes in tax policies or restrictions on gold imports and exports can affect the availability and cost of gold. Additionally, government interventions in the economy can indirectly influence the price of gold.

Counterparty risk in gold investments

When investing in certain gold derivatives or financial products, there may be counterparty risk. This risk arises when the other party involved in the transaction, such as a financial institution or a fund manager, fails to fulfill their obligations. It is important to choose reputable and trustworthy counterparties when investing in gold.

Storage and security concerns

Physical gold investments require proper storage and security measures. Gold bars, coins, and jewelry need to be kept in a secure location, such as a safe deposit box or a specialized storage facility. There are associated costs and risks with storing physical gold, including theft, damage, and insurance expenses.

Factors to Consider Before Investing in Gold

Investment goals and risk tolerance

Before investing in gold, it is crucial to determine your investment goals and assess your risk tolerance. Consider whether you are seeking capital appreciation, wealth preservation, or diversification. Understand the potential risks and volatility associated with gold investments and align them with your investment preferences.

Knowledge of gold market and investment strategies

Having a solid understanding of the gold market and various investment strategies is essential for successful gold investing. Stay informed about global economic conditions, monitor gold price trends, and research different investment options. Consider consulting with financial advisors or experts who specialize in gold investments.

Timing the market and monitoring price trends

Timing the market is challenging, and it is difficult to predict short-term gold price movements. However, monitoring price trends and market indicators can help inform investment decisions. Consider using technical analysis tools and fundamental research to assess the market sentiment and make informed investment choices.

Choosing the right investment vehicle

There are various investment vehicles available for investing in gold. Consider your investment goals, liquidity needs, and preferences when choosing the right vehicle. Physical gold provides tangible ownership, while ETFs offer ease of trading. gold mining stocks and futures provide exposure to the industry. Evaluate the pros and cons of each option.

Investment Options for Long-term Gold Investments

Physical gold: Bars, coins, and jewelry

Investing in physical gold allows you to own tangible assets. You can purchase gold bars, coins, or jewelry from reputable dealers or jewelers. Physical gold provides the satisfaction of physical ownership and can be passed down as an heirloom. However, it requires proper storage and security measures.

Gold exchange-traded funds (ETFs)

Gold ETFs are investment funds that track the price of gold and can be bought and sold on stock exchanges. They offer a convenient way to invest in gold without physically owning it. Gold ETFs provide liquidity, transparency, and diversification benefits. They are suitable for investors seeking exposure to the gold market without the hassle of physical ownership.

Gold mining stocks and mutual funds

Investing in gold mining stocks and mutual funds allows you to gain exposure to the gold mining industry. These investments can provide indirect exposure to gold prices and offer potential returns based on the performance of the mining companies. However, mining stocks can be subject to additional risks, such as operational issues or geopolitical concerns.

Gold futures and options

Gold futures and options allow investors to trade gold prices on futures exchanges. Futures contracts enable buyers and sellers to agree on a predetermined price for gold to be delivered at a specific future date. Options contracts offer the right, but not the obligation, to buy or sell gold at a specified price. However, trading futures and options requires knowledge and expertise.

Taxation and Costs of Gold Investments in Malaysia

Tax implications of buying, selling, and holding gold

In Malaysia, the tax implications of buying, selling, and holding gold depend on various factors, such as the type of gold investment and the duration of ownership. Physical gold purchases may be subject to GST (Goods and Services Tax). Capital gains tax may apply when selling gold, depending on the holding period and the individual’s tax residency status.

Transaction costs and fees

Gold investments may involve transaction costs and fees. When purchasing physical gold, consider the premiums charged by dealers. ETFs may have management fees and brokerage commissions. Gold mining stocks and mutual funds can have expense ratios and brokerage fees. It is essential to understand and factor in these costs when evaluating gold investment options.

Storage and insurance expenses

Physical gold investments require storage and insurance measures, which can incur additional expenses. Safe deposit boxes or specialized storage facilities may charge rental fees. Insurance coverage is recommended to protect against theft, damage, or loss. These storage and insurance expenses should be considered when budgeting for gold investments.

Strategies for Successful Long-term Gold Investing

Dollar-cost averaging

Dollar-cost averaging is an investment strategy where you invest a fixed amount in gold at regular intervals, regardless of the prevailing price. This strategy can help mitigate the impact of price volatility, as you will be buying more gold when prices are low and less when prices are high. Over the long term, dollar-cost averaging can potentially lower the average cost per unit of gold.

Regular portfolio rebalancing

Regularly rebalancing your portfolio can ensure that your gold investments stay aligned with your overall investment strategy. As the value of gold and other assets fluctuates, some assets may become over- or underweight in your portfolio. Rebalancing involves buying or selling assets to maintain the desired allocation, reducing the risk of being too heavily exposed to any particular asset class.

Staying informed and updated on market trends

To make informed investment decisions, staying informed and updated on market trends is crucial. Keep track of global economic conditions, geopolitical events, and factors influencing the gold market. Monitor gold price trends and research various indicators and analysis tools. Regularly read financial news, reports, and expert opinions to stay ahead of market developments.

Seeking professional advice and guidance

Investing in gold can be complex, and seeking professional advice and guidance can be beneficial. Consult with financial advisors, wealth managers, or gold investment experts who can provide personalized advice based on your specific circumstances. They can help assess your goals, evaluate investment options, and provide insights into the gold market.

Expert Opinions on Gold’s Potential Returns

Fund managers’ perspective on gold investments

Fund managers often have differing opinions on gold’s potential returns. Some may see gold as an essential aspect of a well-diversified portfolio, providing downside protection and potential for capital appreciation. Others may view gold as a speculative investment, subject to significant volatility and unpredictable price movements. It is important to consider different perspectives and conduct thorough research.

Analysts’ forecasts for gold prices in Malaysia

Analysts provide forecasts and predictions for gold prices in Malaysia based on various factors, such as economic conditions, supply and demand dynamics, and geopolitical factors. These forecasts can help investors understand the potential future performance of gold. However, it is important to remember that market predictions are not always accurate, and investors should exercise caution.

Case studies of successful gold investors

Studying successful gold investors can provide valuable insights and inspiration. Analyzing case studies of investors who have achieved significant returns from their gold investments can help identify strategies, tactics, and approaches that have worked in the past. However, it is important to remember that past performance does not guarantee future results.

Expert tips for maximizing returns

Experts often provide tips and recommendations for maximizing returns from gold investments. These tips can include strategies such as diversification, dollar-cost averaging, and maintaining a long-term investment perspective. Experts may also emphasize the importance of conducting thorough research, staying informed, and understanding one’s risk tolerance and investment goals.

In conclusion, gold investments in Malaysia offer potential returns and various benefits, including diversification, wealth preservation, and protection against economic uncertainties. However, it is important to understand the factors affecting gold’s long-term performance, the risks involved, and the different investment options available. Consider your investment goals, risk tolerance, and seek professional advice when embarking on a gold investment journey.