You’re about to embark on a thrilling journey into the world of gold mining stocks in the article ‘Gold Mining Stocks: Investing In The Gold Production Industry’. This article will lay out the intrigue of gold production as an investment area and provide you with key insights on how to navigate this potentially lucrative market. It’s an exciting exploration of financial planning centered on the shimmering allure of gold!

Understanding Gold Mining Stocks

investing in gold mining stocks is a way for you to get involved in the gold production industry. If you’re a novice to the idea of investing in gold mining stocks, this guide will provide you with a comprehensive understanding.

Definition of Gold Mining Stocks

Gold mining stocks are shares issued by companies involved in the exploration and mining of gold. When you purchase these stocks, you’re investing in the company’s potential to find and produce gold at a profitable rate. The performance of these stocks is tied to both the success of the company and the prevailing price of gold in the market.

How Gold Mining Stocks Work

These stocks work like any other company stocks. When you buy a gold mining stock, you are buying a portion of the company, making you a part-owner. The value of your stocks can increase when the company’s profits rise, often due to successful exploration and refining or an increase in the market price of gold. Conversely, the value of your stocks can plummet if the company gets hit with challenges such as operational issues or decreases in gold prices.

Pros and Cons of Investing in Gold Mining Stocks

Like any investment, gold mining stocks come with their own sets of advantages and drawbacks.

Advantages of Gold Mining Stocks

One major advantage is leverage. If a company strikes gold, the stock prices can spike, giving investors substantial returns on their investment. Furthermore, you do not need to worry about the storage and safety of physical gold. Lastly, mining stocks may also pay dividends, providing investors with a regular income stream.

Disadvantages of Gold Mining Stocks

On the downside, the performance of these stocks is highly dependent on the company’s operations and the volatile prices of gold. Unlike the actual metal which holds intrinsic value, a company can go bankrupt, causing its stock value to drop dramatically.

Factors Influencing Gold Mining Stocks

A range of factors can pull up or down the value of gold mining stocks.

Global Economic Condition’s Impact

During economic downturns, the price of gold often increases, as people turn to gold as a “safe haven” investment. In return, this increases the value of gold mining stocks. However, when the economy is robust, investors are more likely to move their money into other assets, reducing the demand for gold and potentially devaluating gold mining stocks.

Influence of Gold Prices

Gold prices directly influence the profitability of gold mining companies. When gold prices are high, mining companies can sell their products at higher prices, potentially increasing their profits.

Regulations and Policies

Government regulations and policies for mining, such as taxes and environmental regulations, can significantly impact a mining company’s operations and profitability. Changes in these regulations and policies could mean additional costs for the company, which could affect the value of its stocks.

Operational Efficiency and Production Costs

A mining company’s operational efficiency and production costs also affect its stock value. High operating expenses and low efficiency can cut into profits, potentially reducing stock prices.

Understanding the Risks Involved

Investing in gold mining stocks isn’t without risk. It’s essential to understand the potential risks before investing your money.

Market Volatility

Gold mining stocks are subjected to market volatility. Unexpected economic events can dramatically shift the demand and price for gold, affecting the value of gold mining stocks.

Geopolitical Risks

Gold mines are often located in politically unstable regions. Turmoil or conflict in these regions can hinder mining operations, affecting the company’s profitability.

Environmental Risks

Mining activities are closely linked to environmental issues. Changes in environmental policies or a company’s failure to adhere to these regulations can lead to hefty fines or operations stoppage, imperiling a company’s profits and stock value.

Financial Risks

Like any company, gold mining firms may face financial risks such as bankruptcy. Companies with high debts or poor financial management may struggle to stay profitable, putting your investment at risk.

Types of Gold Mining Stocks

Gold mining stocks can be broadly divided into four categories, each with its own risks and rewards.

Major Gold Mining Companies

These are the big players with vast operations across numerous countries. They are generally considered safer investments due to their size and established track record.

Junior Mining Stocks

Junior mining companies are smaller operators. They can bring higher returns if their exploration efforts pay off, but their stocks can be riskier due to their lack of established mining sites.

Exploration Stage Miners

These miners are in the process of locating and testing potential mining sites. Their stocks are typically the riskiest, but a successful discovery can result in a significant appreciation of their stock value.

Gold Royalty Companies

These companies finance mining operations in exchange for a portion of the gold produced. This type of investment can offer steady returns with less exposure to operational risks.

Strategies for Investing in Gold Mining Stocks

It’s crucial to have a clear strategy when investing in gold mining stocks.

Diversification Strategy

One common approach for managing risk is diversification, that is, spreading investments among different types of gold mining stocks. This way, if one stock performs poorly, others may perform well and offset your losses.

Long Term Strategy versus Short Term Strategy

With a long-term strategy, you’re investing in stocks intending to hold onto them for several years. Conversely, a short-term strategy involves frequent buying and selling of stocks, hoping to gain from short-term price movements.

Choosing the Right Mining Stocks

A crucial part of investing in gold mining stocks is picking the right stocks. This involves researching and understanding a company’s financial health, exploration and mining capabilities, and potential for growth.

Analysing a Gold Mining Company for Investment

Before investing in a gold mining company, it’s crucial to thoroughly assess the company.

Understanding the Company’s Balance Sheet

A company’s balance sheet can provide insightful details about the company’s financial health and stability. It includes information about the company’s assets, liabilities, and shareholders’ equity.

Assessing Company’s Production Efficiency

The efficiency of a company’s production process affects its profitability. Companies with higher production efficiency are often more profitable, which can lead to higher stock prices.

Reviewing the Company’s Quantitative and Qualitative Data

Both quantitative data, such as financial statistics, and qualitative data, such as management quality, are essential factors for analysing a company’s potential for investment.

Profit Potential of Gold Mining Stocks

Understanding how you can profit from gold mining stocks is essential for making informed investment decisions.

Determining Profits and Losses

The main way you can profit from gold mining stocks is through capital appreciation. If the price of a stock increases, you could sell the stock for more than you bought it for, making a profit. However, if the stock price decreases, you could suffer a loss.

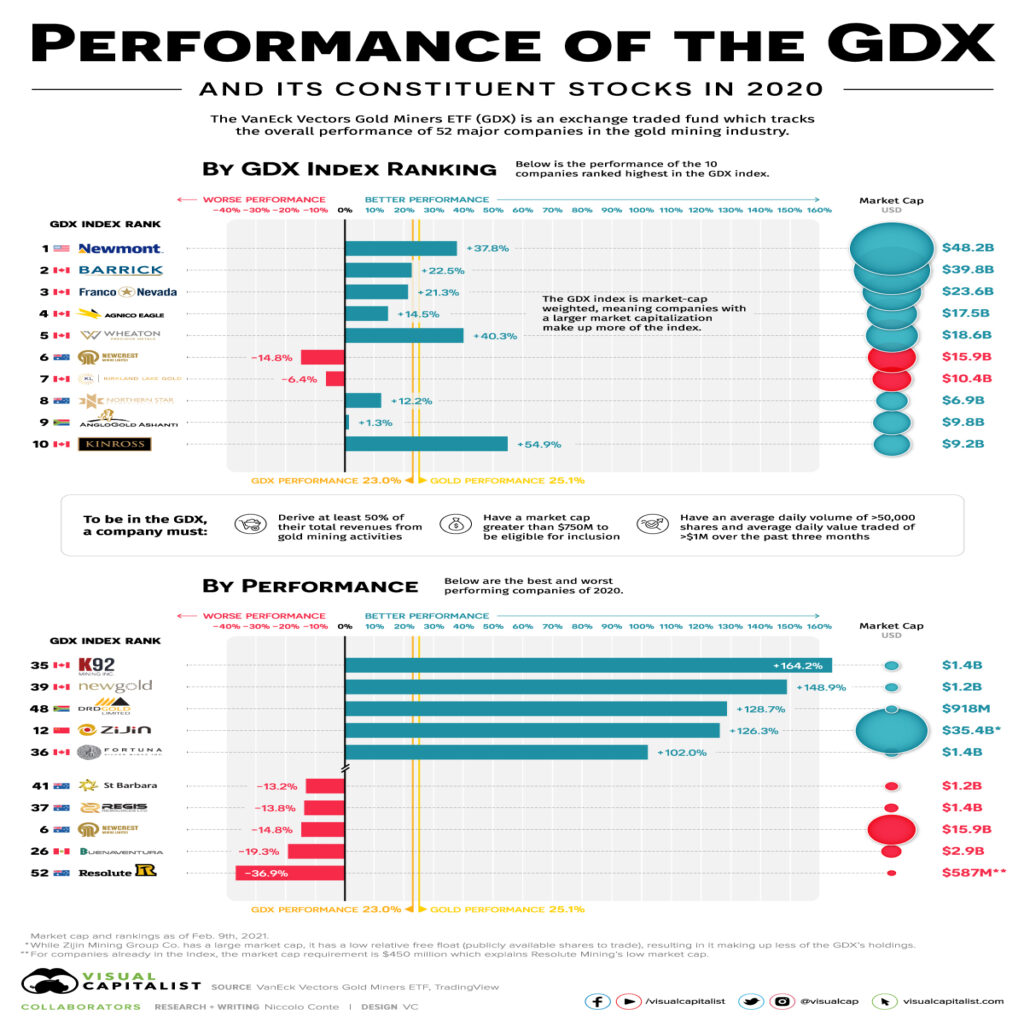

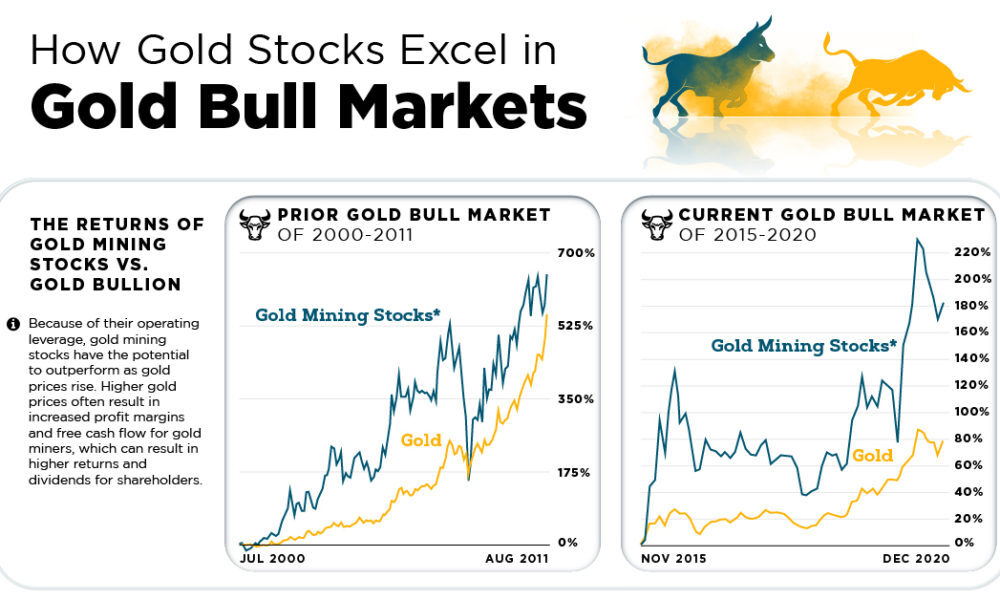

The Correlation Between Gold Prices and Stock Prices

Generally, there’s a positive correlation between gold prices and gold mining stocks. When gold prices rise, mining companies make more profit from selling gold, which in turn, can increase their stock prices.

The Influence of Dividends

Some gold mining companies pay dividends to their shareholders, providing additional income to shareholders on top of any capital gains.

Role of Gold Mining Stocks in Portfolio Management

Including gold mining stocks in your portfolio can bring several advantages.

Benefits of Gold Mining Stocks in Diversification

Gold mining stocks can be a valuable addition for portfolio diversification. They can offer a buffer against fluctuations in other asset classes, such as bonds or traditional stocks, thus stabilizing your portfolio.

Role in Risk Management

Gold mining stocks can also play a role in risk management. For example, during economic downturns, these stocks can outperform many other investments, providing a safe haven.

Impact on Portfolio Returns

Over the long term, gold mining stocks can potentially boost portfolio returns, particularly during bull markets for gold.

Future of Gold Mining Industry

The gold mining industry is constantly evolving, and understanding future industry developments can inform your investment decisions.

Innovation and Technology in Gold Mining

Advanced technology and innovation are playing an increasingly vital role in gold mining. These innovations can enhance mining efficiency and profitability, benefiting gold mining companies and their stockholders.

Impact of Environmental Regulations

Environmental regulations are becoming increasingly stringent worldwide. Companies that adhere to these regulations and employ sustainable mining practices are likely to fare better in the future.

Demand and Supply Projections

The future demand and supply for gold can dramatically shape the gold mining industry. Rising demand could motivate more exploration and mining activities, potentially increasing the value of gold mining stocks.