Have you ever wondered if it’s possible to set up a joint gold investment account with someone in Malaysia? Well, wonder no more! In this article, we will explore the ins and outs of joint gold investment accounts, giving you all the information you need to know. Whether you’re a seasoned gold investor or just starting out, we’ve got you covered. So, sit back, relax, and let’s dive into the world of joint gold investment accounts in Malaysia.

Introduction

When it comes to investing in gold, joint gold investment accounts provide an attractive option for individuals looking to pool their resources and share the benefits and risks of gold investment. In Malaysia, joint gold investment accounts are regulated by specific laws and guidelines to ensure fairness and transparency for all parties involved. In this comprehensive article, we will explore the definition, features, and benefits of joint gold investment accounts, as well as the risks and considerations to keep in mind. We will also delve into the legal regulations surrounding these accounts in Malaysia, including the requirements, restrictions, and limitations. Furthermore, we will provide guidance on choosing the right partner for a joint gold investment account, the steps involved in setting up the account, and essential tips for effectively managing the account. We will also discuss the taxation and reporting obligations associated with joint gold investments, as well as the procedures for exiting such an account. Lastly, we will examine real-life case studies, success stories, challenges, and lessons learned to offer a well-rounded understanding of joint gold investment accounts. By the end of this article, you will be equipped with the knowledge and insights necessary to make informed decisions about joint gold investment accounts in Malaysia.

Understanding Joint Gold Investment Accounts

Definition

A joint gold investment account is a cooperative investment arrangement in which two or more individuals pool their financial resources to invest in gold. These accounts are typically offered by financial institutions or investment providers and allow individuals to share the risks, costs, and returns associated with gold investment.

Features and Benefits

Joint gold investment accounts offer several features and benefits that make them an appealing option for investors. Firstly, they provide the opportunity to diversify investment portfolios by incorporating gold, which can act as a hedge against inflation and economic uncertainty. Additionally, joint gold investment accounts allow individuals to leverage their collective purchasing power, potentially gaining access to larger quantities of gold, which may result in better pricing and economies of scale. Moreover, these accounts enable investors to benefit from shared research and expertise, as well as reduce administrative burdens through collective decision-making and management. Lastly, joint gold investment accounts foster a sense of shared responsibility and accountability among the account holders, promoting collaboration and teamwork.

Risks and Considerations

While joint gold investment accounts may offer numerous advantages, it is essential to be aware of the potential risks and considerations associated with this investment strategy. One significant risk is the potential for disagreement and conflict among the account holders, which can impede decision-making and lead to financial losses. Additionally, the fluctuating nature of gold prices and market volatility can expose investors to substantial financial risks. It is crucial for account holders to have a clear understanding of each other’s financial goals, risk tolerance levels, and investment strategies to mitigate these risks. Adequate communication, transparency, and trust are vital elements in the successful management of a joint gold investment account.

Legal Regulations in Malaysia

Overview of Gold Investment Regulations

In Malaysia, the gold investment industry is regulated by various authorities, including the Securities Commission Malaysia (SC), the Central Bank of Malaysia (BNM), and the Companies Commission of Malaysia (CCM). These regulatory bodies aim to promote investor protection, maintain market integrity, and ensure fair practices within the gold investment sector. It is essential for individuals considering a joint gold investment account to be aware of the legal framework and regulations that govern these accounts to ensure compliance and mitigate potential risks.

Requirements for Joint Gold Investment Accounts

To open a joint gold investment account in Malaysia, certain requirements must be met. Firstly, all account holders must fulfill the eligibility criteria set by the financial institution or investment provider. This typically includes age restrictions, identity verification, and a minimum level of financial stability. Additionally, account holders must provide necessary documentation, such as identification documents, proof of address, and bank statements. It is crucial to carefully review the specific requirements of the chosen gold investment provider to ensure a smooth account opening process.

Restrictions and Limitations

While joint gold investment accounts offer numerous advantages, specific restrictions and limitations exist to protect the interests of all parties involved. For instance, there may be a maximum number of account holders allowed or a cap on the total investment amount. Restrictions on withdrawals and termination procedures may also be in place. It is crucial to thoroughly review the terms and conditions of the joint gold investment account to understand these limitations fully.

Choosing a Partner

Eligibility Criteria

Selecting the right partner(s) for a joint gold investment account is crucial to the success of the venture. When considering potential partners, it is essential to evaluate their eligibility based on the requirements set by the chosen gold investment provider. Factors such as age, financial stability, and identity verification should be taken into account to ensure compatibility and compliance.

Financial Compatibility

A key consideration in choosing a partner for a joint gold investment account is financial compatibility. It is important to assess the partner’s financial goals, risk tolerance, investment strategy, and available resources. Shared financial compatibility can enhance collaboration, decision-making, and shared accountability within the account.

Trust and Communication

Trust and communication are fundamental aspects of any joint investment endeavor. Establishing open and transparent communication with potential partners is essential to ensure a shared understanding of investment objectives, expectations, and decision-making processes. Mutual trust is crucial for effective collaboration and the long-term success of the joint gold investment account.

Steps to Set Up a Joint Gold Investment Account

Research and Planning

Before setting up a joint gold investment account, conducting thorough research and careful planning is essential. This includes understanding the gold market, assessing risk factors, and evaluating different gold investment providers. Account holders should also define their investment goals, establish a timeline, and determine the desired level of involvement in the decision-making and management processes.

Selection of Gold Investment Provider

Choosing the right gold investment provider is a critical step in setting up a joint gold investment account. Factors to consider include reputation, regulatory compliance, fees and charges, investment products and services offered, customer support, and overall suitability for the account holders’ needs and preferences. It is advisable to compare multiple providers and seek recommendations from trusted sources before making a final decision.

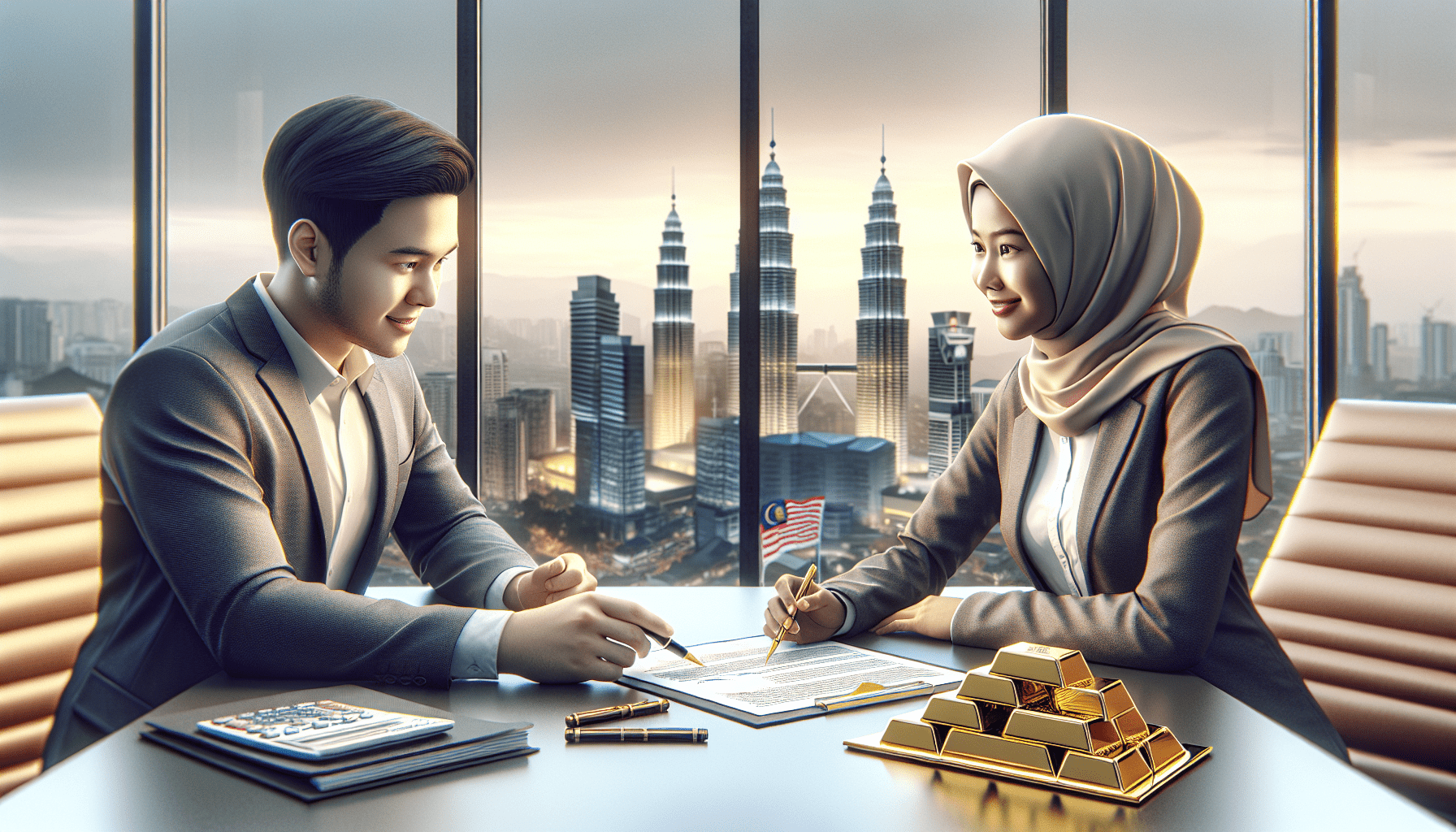

Account Opening Procedure

Once the research is complete and the gold investment provider has been chosen, the next step is to initiate the account opening procedure. This typically involves completing application forms, providing necessary documentation, and fulfilling any additional requirements specified by the provider. It is important to carefully review and understand the terms and conditions of the joint gold investment account before signing any agreements.

Signing the Agreement

The final step in setting up a joint gold investment account is signing the agreement with the chosen provider. This agreement will outline the rights, responsibilities, and obligations of all account holders, as well as any specific terms and conditions regarding investment strategies, decision-making processes, fees, and withdrawal procedures. It is crucial for all parties to review this agreement carefully and seek professional advice if needed before signing.

Managing a Joint Gold Investment Account

Allocating Investments

Once the joint gold investment account is set up, the next step is to allocate investments among the account holders. This involves determining the proportion of funds contributed by each party and deciding on the allocation of these funds to different types of gold investments, such as physical gold, gold futures, or gold exchange-traded funds (ETFs). It is important to maintain open communication and reach mutual agreement on investment decisions to ensure fairness and transparency.

Monitoring Performance

Regular monitoring of the performance of the joint gold investment account is crucial to assess the progress towards investment goals and make informed decisions. Account holders should stay updated on gold market trends, track the performance of different gold investments, and evaluate the overall portfolio performance. This allows for timely adjustments and potential rebalancing to optimize returns and manage risks effectively.

Decision-Making Process

In a joint gold investment account, decision-making is a collaborative process involving all account holders. It is important to establish clear channels of communication, discuss investment decisions, and reach mutual agreement to ensure transparency and avoid conflicts. Regular meetings or updates can facilitate the decision-making process and provide a platform for sharing insights and perspectives among the account holders.

Communication and Transparency

Effective communication and transparency are vital for the successful management of a joint gold investment account. Regular updates, open discussions, and sharing of information regarding investment strategies, performance, and potential challenges foster a sense of trust, accountability, and collective responsibility. It is crucial to maintain open lines of communication and address any concerns or disagreements promptly to ensure the smooth functioning of the account.

Taxation and Reporting Obligations

Tax Implications of Joint Gold Investments

Account holders of joint gold investment accounts should be aware of the tax implications associated with their investments. In Malaysia, the taxation of gold investments is subject to specific rules and regulations. Capital gains tax, income tax, and goods and services tax (GST) may apply depending on the nature and duration of the investment. It is advisable to consult a tax professional or seek guidance from the relevant authorities to ensure compliance and optimize tax planning strategies.

Reporting Requirements

Account holders of joint gold investment accounts are generally required to fulfill reporting obligations to the relevant authorities. This includes disclosing investment details, income generated, and any relevant changes in the account. Compliance with reporting requirements is essential to maintain transparency and meet regulatory obligations. Seeking professional advice or referring to official guidelines can help account holders navigate the reporting process effectively.

Seeking Professional Advice

Given the complexities of taxation and reporting obligations, it is recommended to seek professional advice from tax consultants or financial advisors who specialize in gold investments. These professionals can provide valuable insights and personalized guidance based on individual circumstances to ensure compliance with legal requirements and optimize tax planning strategies. It is important to engage with trusted professionals who have a deep understanding of Malaysian taxation laws and regulations.

Exiting a Joint Gold Investment Account

Termination and Withdrawal Procedures

Exiting a joint gold investment account can occur for various reasons, including achieving investment goals, changes in personal circumstances, or disagreements among account holders. Account holders should review the terms and conditions of the joint gold investment account to understand the termination and withdrawal procedures. This may involve providing prior notice, completing necessary paperwork, and adhering to any imposed restrictions or penalties. It is important to follow the established procedures to ensure a smooth and fair exit from the account.

Distribution of Assets

Upon exiting a joint gold investment account, the distribution of assets among the account holders needs to be determined. This is typically based on the proportion of funds contributed by each party and the agreed-upon allocation of investments. It is important to have open discussions and reach mutual agreement on the distribution process to ensure fairness and minimize conflicts. Seeking legal advice or mediation services may be beneficial to facilitate this process.

Mediation and Dispute Resolution

In cases where disagreements or disputes arise among account holders, seeking mediation or dispute resolution services may be necessary. Engaging a neutral third party can help navigate conflicts and facilitate a fair resolution that considers the interests and rights of all parties involved. Mediation can provide a platform for open communication, compromise, and finding mutually agreeable solutions to protect investments and relationships.

Case Studies and Examples

Real-Life Scenarios

To further illustrate the dynamics and practical aspects of joint gold investment accounts, real-life scenarios can provide valuable insights. These case studies can showcase different investment strategies, challenges encountered, and outcomes achieved. By examining how others have successfully navigated joint gold investment accounts, individuals can gather inspiration, lessons learned, and a better understanding of the potential risks and rewards associated with these accounts.

Success Stories

Success stories of individuals who have achieved their investment goals through joint gold investment accounts can serve as motivation and encouragement for others. These stories can highlight the power of collaboration, effective decision-making, and commitment towards shared objectives. By sharing success stories, aspiring joint gold investors can gain confidence and inspiration to embark on their own investment journeys.

Challenges and Lessons Learned

Overcoming challenges is an inherent part of any investment endeavor, and joint gold investment accounts are no exception. By examining the challenges faced by individuals in managing and exiting such accounts, valuable lessons can be learned. These challenges may range from financial disagreements to market volatility or changes in personal circumstances. Learning from the experiences of others can help individuals anticipate potential obstacles and develop strategies to overcome them.

Conclusion

Joint gold investment accounts offer a unique and collaborative approach to investing in gold. By pooling financial resources and sharing the benefits and risks, individuals in Malaysia can tap into the potential of the gold market while fostering trust, communication, and collective decision-making. Understanding the features, benefits, risks, and legal regulations associated with joint gold investment accounts is essential for anyone considering this investment strategy. By carefully selecting a compatible partner, following the necessary steps to set up the account, and effectively managing the investments, individuals can optimize their chances of success. Additionally, awareness of the taxation and reporting obligations, as well as the procedures for exiting such accounts, ensures compliance and protects the interests of all parties involved. By learning from real-life case studies and personal experiences, individuals can gain valuable insights, inspiration, and an understanding of the challenges and lessons learned in joint gold investment accounts. With the knowledge and guidance provided in this comprehensive article, individuals can confidently explore the world of joint gold investment accounts in Malaysia and make informed decisions that align with their financial goals and aspirations.