Interested in investing in gold in Malaysia? Wondering if there are any restrictions on taking physical possession of gold from banks? Look no further! In this article, we will explore the regulations and rules surrounding the process of acquiring physical gold from banks in Malaysia. Whether you’re a seasoned gold investor or just starting out, we’ll provide you with all the information you need in a friendly and informative manner. So sit back, relax, and let’s dive into the world of gold investment in Malaysia!

Bank Policies Regarding Physical Possession

When it comes to purchasing and storing gold, banks play a crucial role in ensuring the safety and security of your precious metal. In this article, we will explore the various bank policies regarding physical possession of gold. We will delve into topics such as the purchase of gold from banks, storage options available, loans against gold, and the withdrawal process. So, let’s jump right in!

Purchase of Gold from Banks

One of the convenient ways to acquire gold is through banks. Many banks offer gold purchasing services to their customers, making it easily accessible for both investors and enthusiasts. However, it’s essential to understand the specific policies and procedures each bank has in place.

Before making a purchase, it’s advisable to research different banks and compare their rates and services. Some banks may offer competitive pricing, while others may have additional benefits such as loyalty programs or discounts for existing customers. It’s also a good idea to inquire about the purity of the gold being offered, as well as any accompanying certificates or documentation.

Storage Options

Once you’ve purchased gold from a bank, you’ll need to consider storage options. Banks usually provide safekeeping facilities to store your gold securely. These facilities are equipped with high-level security systems and protocols to protect your precious metal.

Before opting for a specific storage option, it’s crucial to understand the terms and conditions provided by the bank. Some banks may charge fees for storing your gold, while others may have specific requirements or limitations. It’s essential to ask questions and seek clarification to ensure you fully understand the bank’s policies regarding the storage of your gold.

Loan Against Gold

In times of financial need, having an asset like gold can be advantageous. Banks offer the option of obtaining a loan against your gold holdings. This allows you to utilize the value of your gold without selling it outright.

When applying for a loan against your gold, banks will assess its value and provide you with a loan amount based on a percentage of that value. The interest rates and repayment terms may vary from bank to bank, so it’s essential to evaluate different options and choose the one that suits your needs best.

Withdrawal Process

There may come a time when you decide to withdraw your gold from the bank. Whether it’s for personal use, gifting, or transferring ownership, banks generally have a systematic process in place for such withdrawals.

Before initiating a withdrawal, it’s essential to communicate with the bank and understand their specific requirements. This may include providing valid identification and necessary documentation. It’s advisable to inquire about any fees or charges associated with the withdrawal process to avoid any surprises later on.

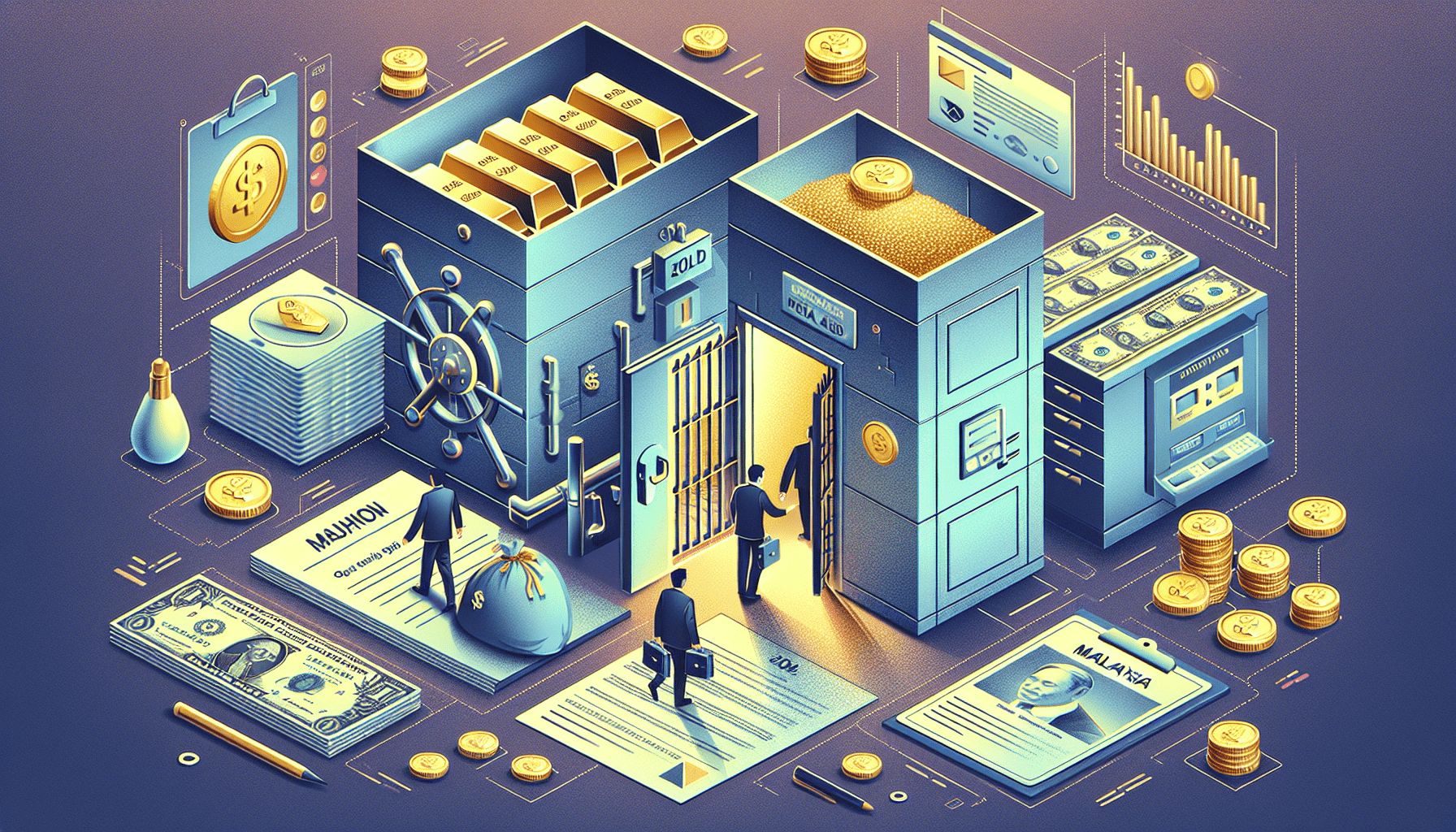

Banks as Custodians of Gold

Banks not only offer gold purchasing services but also serve as custodians for the precious metal. In this section, we will discuss the different types of gold held by banks, the licensing and regulation governing their operations, and the responsibilities they have in safeguarding your gold.

Types of Gold Held by Banks

Banks hold various types of gold as part of their custodial services. These may include physical gold bars, gold coins, and even gold jewelry. Each bank may have different offerings, so it’s important to inquire about the specific types of gold they hold before engaging their custodial services.

Licensing and Regulation

For banks to operate as custodians of gold, they must adhere to specific licensing and regulatory requirements. These requirements ensure that banks operate in a secure and transparent manner, safeguarding the interests of their customers.

Regulatory bodies such as central banks or financial authorities often oversee the operations of custodial services offered by banks. These bodies set guidelines and standards that banks must comply with to maintain their licensing. It’s crucial for investors to choose banks that are regulated and licensed to ensure the safety of their gold.

Responsibilities of Banks

As custodians of gold, banks have certain responsibilities towards their customers. These responsibilities include ensuring the physical security of the gold, maintaining accurate records of ownership, and providing transparent and efficient services.

Banks should have robust security measures in place to protect the gold held in their custody. This may include state-of-the-art vaults, 24/7 surveillance, and stringent access controls. It’s crucial for customers to inquire about the security measures employed by the bank to ascertain the safety of their gold.

Additionally, banks should maintain accurate records of ownership, allowing customers to verify their holdings at any given time. Transparency is essential in building trust between the bank and its customers. Furthermore, banks should provide efficient services, such as prompt delivery or transfer of gold when requested by the customer.

Government Regulations

When it comes to dealing with gold, government regulations play a significant role. In this section, we will explore the various regulations that govern the gold industry, including central bank guidelines, customs and import regulations, and tax considerations.

Central Bank Guidelines

Central banks often formulate guidelines and regulations regarding gold holdings and transactions. These guidelines are in place to ensure the stability of the financial system and protect the interests of the public. It’s crucial for banks and individuals to adhere to these guidelines to avoid any legal implications.

Central bank guidelines may cover aspects such as reporting requirements for gold transactions, restrictions on gold exports and imports, and guidelines for gold-backed financial products. It’s essential for banks and individuals to stay updated with these guidelines to remain compliant with the law.

Customs and Import Regulations

When importing or exporting gold, customs and import regulations come into play. Each country may have its specific regulations governing the movement of gold across borders. It’s crucial for individuals to familiarize themselves with these regulations to avoid any legal issues or delays.

Customs regulations typically require individuals to declare their gold holdings when crossing borders. Failure to comply with these regulations may result in penalties or even confiscation of the gold. It’s advisable to consult with customs authorities or seek professional advice before undertaking any gold-related cross-border transactions.

Tax Considerations

Tax considerations are a vital aspect of gold ownership and transactions. The tax implications may vary depending on the jurisdiction and the type of transaction involved. It’s important to understand the tax obligations associated with gold ownership, such as capital gains tax or wealth tax.

Different countries have different tax laws, so it’s advisable to seek professional advice or consult tax authorities to ensure compliance. Additionally, banks may provide information on tax considerations related to gold transactions, helping individuals make informed decisions.

Personal Gold Ownership

While banks offer convenience and security for gold storage, some individuals prefer to own and store their gold personally. In this section, we will discuss the options for buying gold from other sources, storing gold at home, and the importance of insurance coverage and safety precautions.

Buying Gold from Other Sources

Apart from banks, there are various other sources from which you can buy gold. These sources include authorized gold dealers, jewelry stores, online platforms, and even private sellers. When purchasing gold from these sources, it’s essential to exercise caution and ensure authenticity.

Authorized gold dealers and reputable jewelry stores often provide certificates of authenticity for their gold products. This helps in verifying the purity and quality of the gold. Online platforms should be researched thoroughly, and feedback from previous customers should be considered before making a purchase. When dealing with private sellers, it’s advisable to seek professional advice and conduct the necessary due diligence.

Storing Gold at Home

For those who prefer to have physical possession of their gold, storing it at home is an option. However, it’s important to understand the risks involved and take appropriate safety precautions.

When storing gold at home, it’s essential to have secure storage solutions in place. This may include safes, locked cabinets, or even safety deposit boxes at reputable banks. Adequate insurance coverage should also be obtained to protect against any unforeseen events such as theft or natural disasters.

It’s crucial to remember that storing gold at home may not provide the same level of security and protection as banks or specialized storage facilities. Therefore, individuals should carefully assess the risks and benefits before opting for this method of gold storage.

Insurance Coverage and Safety Precautions

Regardless of where and how you store your gold, having sufficient insurance coverage is of utmost importance. Insurance policies specifically designed for precious metals can provide financial protection in case of loss, theft, or damage to your gold.

Before purchasing insurance coverage, it’s important to read and understand the policy terms and conditions. This may include limitations on coverage, appraisal requirements, and any deductibles or excess amounts. It’s also advisable to take photographs or keep a detailed inventory of your gold holdings as evidence in case of a future insurance claim.

Safety precautions should also be taken when handling and storing gold. This includes keeping your gold in a secure and discreet location, restricting access to trusted individuals, and avoiding discussing your gold holdings openly. By taking these precautions, you can minimize the risk of unwanted attention and potential security breaches.

Gold Investment Options

Gold not only holds intrinsic value but also serves as an investment asset. In this section, we will explore different gold investment options, including gold savings accounts, gold ETFs and mutual funds, as well as gold certificates.

Gold Savings Accounts

Gold savings accounts provide individuals with an opportunity to invest in gold while enjoying the convenience and flexibility of a bank account. These accounts are typically offered by banks and allow individuals to buy and sell gold at prevailing market rates.

Gold savings accounts function similarly to regular savings accounts, with the difference being that the funds are held in gold instead of traditional currency. The gold holdings are tracked electronically, and individuals receive statements detailing their account balance. It’s important to review the terms and conditions of the gold savings account, including any fees or charges associated with account maintenance or transactions.

Gold ETFs and Mutual Funds

Gold ETFs (Exchange-Traded Funds) and mutual funds provide investors with a more diversified approach to investing in gold. These investment vehicles pool funds from multiple investors and use the capital to invest in a portfolio of gold-related assets.

Gold ETFs are traded on stock exchanges, and their prices fluctuate throughout the trading day, similar to stocks. They provide investors with an easily accessible and liquid way to invest in gold without physically owning the metal. Mutual funds, on the other hand, are managed by professional fund managers who make investment decisions on behalf of the investors.

Investing in gold ETFs or mutual funds allows individuals to benefit from the expertise of fund managers and gain exposure to a broader range of gold-related assets. However, it’s essential to assess the fees, performance history, and risk factors associated with these investment options before making a decision.

Gold Certificates

Gold certificates are another form of investment where individuals can indirectly own gold. These certificates represent ownership of a certain quantity of gold held by a bank or a trusted entity. Investors receive certificates that document their ownership, allowing them to trade or transfer their gold holdings without physically possessing the metal.

Gold certificates provide individuals with convenience and flexibility, as they eliminate the need for physical storage and transportation of gold. However, it’s crucial to choose reputable issuers of gold certificates and review the terms and conditions of the certificate carefully. Additionally, investors should inquire about redemption policies and the ability to convert the certificates into physical gold if desired.

Advantages and Disadvantages

As with any investment or storage option, there are advantages and disadvantages to consider. In this section, we will explore the benefits of keeping gold in banks, the drawbacks of banking gold, and alternative investments worth considering.

Benefits of Keeping Gold in Banks

One of the primary advantages of banking gold is the high level of security and protection provided by banks. Banks invest significant resources in ensuring the physical and digital security of their customers’ gold holdings. This can provide peace of mind to investors who prioritize safety and convenience.

Another benefit of banking gold is the ability to access additional services offered by banks. These services may include loans against gold, expert advice on gold investments, and the convenience of buying or selling gold within the same institution. Banks may also provide transparency and records of ownership, making it easier for investors to track their gold holdings effectively.

Drawbacks of Banking Gold

One of the drawbacks of banking gold is the associated costs. Banks may charge fees for various services, such as gold storage or transactions. These fees can add up over time and may impact the overall returns on your investment. It’s crucial to evaluate the costs involved and compare them with alternative storage or investment options.

Another drawback is the potential lack of physical possession. If you value the ability to physically hold your gold or have immediate access to it, banking gold may not be the ideal option. While banks offer high levels of security, there may be restrictions or delays when it comes to withdrawing or accessing your gold.

Alternative Investments

For investors seeking alternative options to gold or diversifying their portfolio, there are several options to consider. These may include other precious metals such as silver or platinum, real estate, stocks, or even digital assets such as cryptocurrencies.

Each alternative investment carries its own unique advantages and risks, so it’s important to conduct thorough research and seek professional advice before investing. Diversification is key when it comes to managing investments, as it helps mitigate risk and maximize potential returns.

Future Outlook

The gold industry is constantly evolving, influenced by changing regulations, emerging trends, and technological advancements. In this section, we will explore the potential changes in regulations, the emerging trends in gold ownership, and the implications for investors.

Potential Changes in Regulations

Regulations surrounding gold ownership and transactions are subject to change over time. Governments and regulatory bodies may introduce new guidelines or amend existing regulations to adapt to evolving market conditions or address specific concerns.

It’s essential for investors to stay informed about potential changes in regulations that may impact their gold holdings. This can be done by regularly consulting with financial advisors, following industry news, or monitoring updates from relevant regulatory authorities.

Emerging Trends in Gold Ownership

As the world becomes more connected and digital, emerging trends in gold ownership are beginning to take shape. One such trend is the digitization of gold assets, where investors can own fractional amounts of gold represented by digital tokens or cryptocurrencies. This allows for increased accessibility and liquidity while maintaining exposure to the value of gold.

Additionally, gold-backed cryptocurrencies are gaining popularity, providing a bridge between the traditional world of gold ownership and the digital realm. These cryptocurrencies are typically backed by physical gold held in secure vaults, offering investors a combination of the stability of gold and the convenience of digital currencies.

Implications for Investors

The evolving landscape of gold ownership presents both opportunities and challenges for investors. It’s important for investors to embrace new technologies and explore emerging trends while remaining cautious and informed. A diversified approach to gold ownership and investment can help mitigate risks and capitalize on potential opportunities.

Investors should also continue to monitor regulatory developments and adjust their strategies accordingly. By staying informed and adapt to changing market conditions, investors can position themselves to navigate the future of gold ownership successfully.

Expert Insights

To gain further insights into gold ownership, we reached out to gold investment advisors and financial experts. Their expertise sheds light on various aspects of gold ownership, providing valuable insights for both novice and experienced investors.

Interviews with Gold Investment Advisors

We had the opportunity to interview renowned gold investment advisors who shared their expertise on different strategies and considerations when it comes to gold ownership. They provided insights into topics such as timing your gold investments, diversification strategies, and long-term outlook for gold as an asset class.

These interviews offer a valuable perspective from industry experts who have extensive experience navigating the nuances of the gold market. Their insights can help investors make informed decisions and maximize the benefits of gold ownership.

Opinions from Financial Experts

In addition to gold investment advisors, we also gathered opinions from financial experts who shared their thoughts on gold as an investment asset. These experts provided insights into the role of gold in a well-diversified portfolio, economic factors influencing gold prices, and potential risks and rewards associated with gold investments.

By analyzing the opinions of these experts, investors can gain a broader perspective and make more informed decisions regarding their gold investments. The wisdom and insights shared by financial experts can help investors navigate the complexities of the gold market with confidence.

Case Studies of Gold Ownership

To provide practical examples and real-life scenarios, we have included case studies of individuals who have successfully owned and managed their gold investments. These case studies highlight the strategies, challenges, and outcomes of their gold ownership journeys, offering valuable lessons for readers.

By studying these case studies, investors can gain insights into the practical aspects of gold ownership and better understand the potential risks and rewards associated with their investments. Each case study presents a unique perspective, allowing readers to draw inspiration and apply relevant strategies to their own investment journeys.

Conclusion

In conclusion, bank policies regarding physical possession of gold play a vital role in the gold ownership landscape. Whether it’s purchasing gold from banks, utilizing their storage options, or exploring gold-backed financial products, banks provide convenient and secure avenues for individuals to own and invest in gold.

Government regulations regarding gold ownership, customs and import regulations, and tax considerations significantly impact the gold industry. Investors should familiarize themselves with these regulations and seek professional advice to ensure compliance and maximize the benefits of gold ownership.

Personal gold ownership offers individuals the flexibility to choose alternative sources for buying gold and the option to store gold at home. However, it’s important to weigh the risks and benefits of personal possession while taking appropriate safety precautions and obtaining adequate insurance coverage.

Gold investment options, such as gold savings accounts, gold ETFs and mutual funds, and gold certificates, offer investors a range of choices to diversify their portfolios. Understanding the advantages and disadvantages of these options can help investors make informed decisions based on their investment goals and risk appetite.

The future outlook for gold ownership presents both challenges and opportunities. As regulations evolve and technological advancements emerge, investors should stay informed, adapt their investment strategies, and explore emerging trends to maximize their returns and navigate the changing landscape successfully.

Expert insights from gold investment advisors and financial experts provide valuable guidance for investors. By leveraging their expertise and analyzing case studies of successful gold ownership, investors can gain practical knowledge and make more informed decisions regarding their gold investments.

In summary, gold ownership provides individuals with a tangible asset that holds intrinsic value and serves as a diversification tool. When navigating the world of gold ownership, it’s essential to understand bank policies, government regulations, personal ownership options, investment choices, and expert insights. By doing so, investors can make informed decisions and embark on a rewarding journey of gold ownership.