Are you interested in learning about the process of buying and selling gold with a Malaysian bank? In this article, we will guide you through the steps involved in this fascinating investment opportunity. Whether you’re a seasoned gold investor or a curious beginner, we will provide you with insightful information, helpful tips, and a friendly approach to ensure you have a thorough understanding of the process. So, let’s embark on this journey together and explore the world of gold investment with a Malaysian bank.

Researching Malaysian Banks that Offer Gold Buying and Selling Services

When it comes to buying and selling gold in Malaysia, it is important to choose a reputable bank that offers reliable services. This article will guide you through the process of researching and identifying such banks.

Identifying reputable banks in Malaysia

To start your research, make a list of banks in Malaysia that are well-known and have a good reputation. Some of the prominent banks that offer gold buying and selling services include Maybank, CIMB Bank, and Public Bank. These banks have a long-standing presence in the country’s financial industry and are trusted by many Malaysians.

Researching the gold buying and selling services offered by these banks

Once you have identified the reputable banks, it is important to delve deeper into their gold buying and selling services. Visit their official websites and look for dedicated sections or pages that provide comprehensive information on these services. Take note of the types of gold they offer, the fees they charge, and any additional services or perks they provide.

Comparing the fees, rates, and terms of different banks

One of the key factors to consider when choosing a bank for buying and selling gold is the fees and rates they charge. Carefully compare the fees and rates offered by different banks to ensure you get the best value for your investment. Some banks may have lower fees but higher rates, while others may have higher fees but lower rates. Consider your investment goals and preferences when making your decision.

Reading customer reviews and experiences

To get a better understanding of the quality of services provided by the banks you are considering, read customer reviews and experiences. Look for online forums, social media groups, or websites where people discuss their experiences with buying and selling gold through these banks. Pay attention to the overall satisfaction level, the promptness of transactions, and any issues or concerns raised by customers. By considering the feedback of others, you can make a more informed decision.

Understanding the Types of Gold Available for Purchase

Before you proceed with buying gold, it is important to have a clear understanding of the different types of gold available for purchase. This knowledge will help you make an informed decision on the specific type of gold you want to buy.

Exploring the different forms of gold available, such as bars, coins, and jewelry

Gold can be purchased in various forms, including bars, coins, and jewelry. Gold bars are typically available in different weights and are preferred by those looking for a higher investment value. Gold coins, on the other hand, not only have intrinsic value but can also be collector’s items. Jewelry made of gold is another popular form of investment, as it combines aesthetic value with the value of the precious metal.

Understanding the purity and weight measurements of gold

When buying gold, it is crucial to understand the purity and weight measurements used in the industry. The purity of gold is measured in karats, with 24 karat gold being the purest form. Lower karat gold contains a higher percentage of other metals, making it less pure. Gold weight is measured in troy ounces, grams, or kilos. Familiarize yourself with these measurements to ensure you know exactly what you are purchasing.

Considering the advantages and disadvantages of each type of gold

Each form of gold has its own advantages and disadvantages. Gold bars provide a higher investment value and are easily stored, but may have higher premiums due to their purity. Gold coins offer both investment value and collector’s value, but their price may vary depending on factors such as rarity and condition. Jewelry made of gold combines beauty and investment value, but may have additional costs involved, such as craftsmanship and design. Consider your investment goals, budget, and personal preferences when deciding which type of gold to purchase.

Determining the specific type of gold you want to buy

Based on your research and understanding of the different types of gold available, determine the specific type of gold you want to buy. Consider factors such as investment value, aesthetic appeal, and ease of storage or liquidity. Once you have a clear idea of the type of gold you want, you can proceed with opening a gold investment account with your chosen bank.

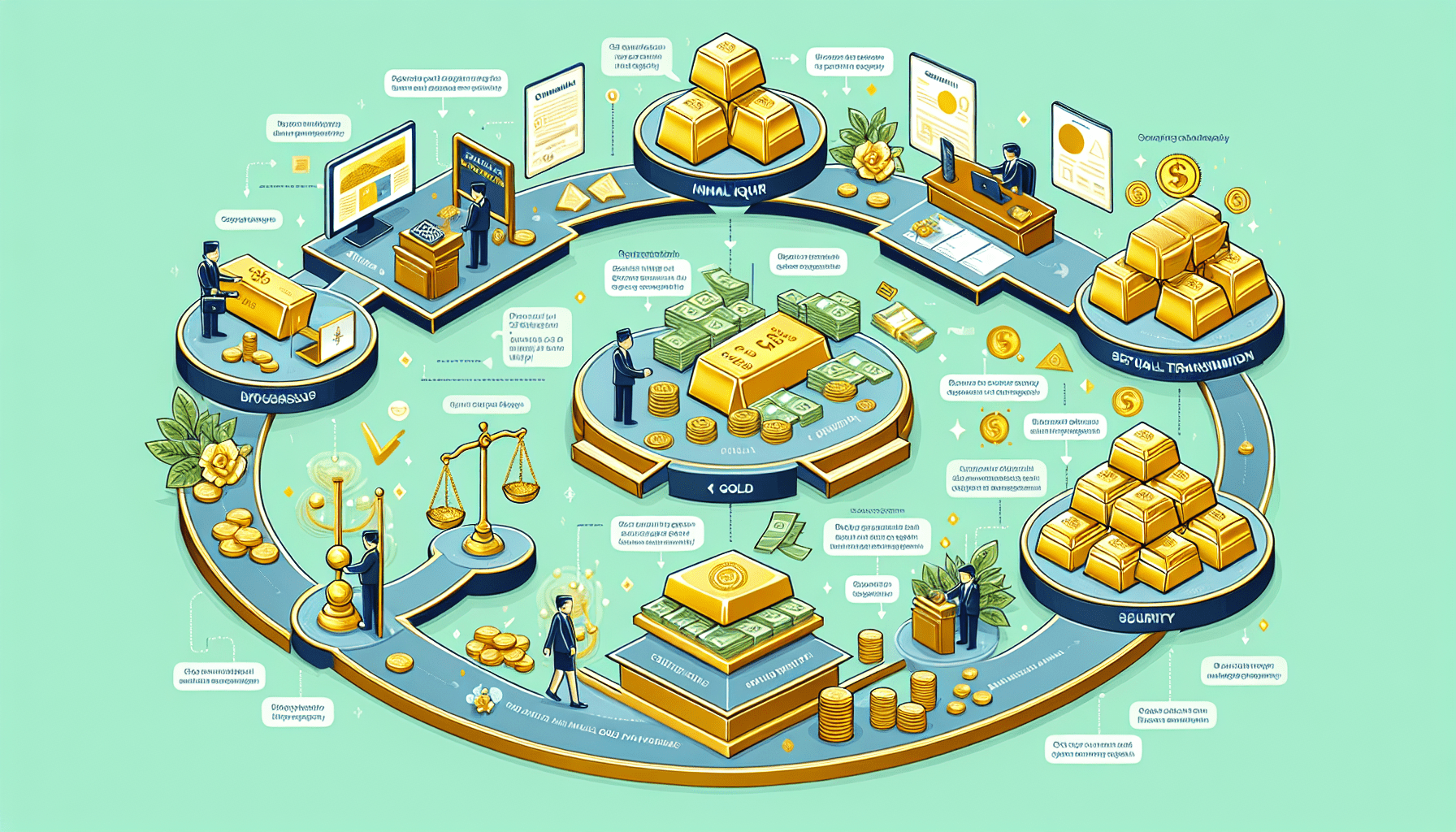

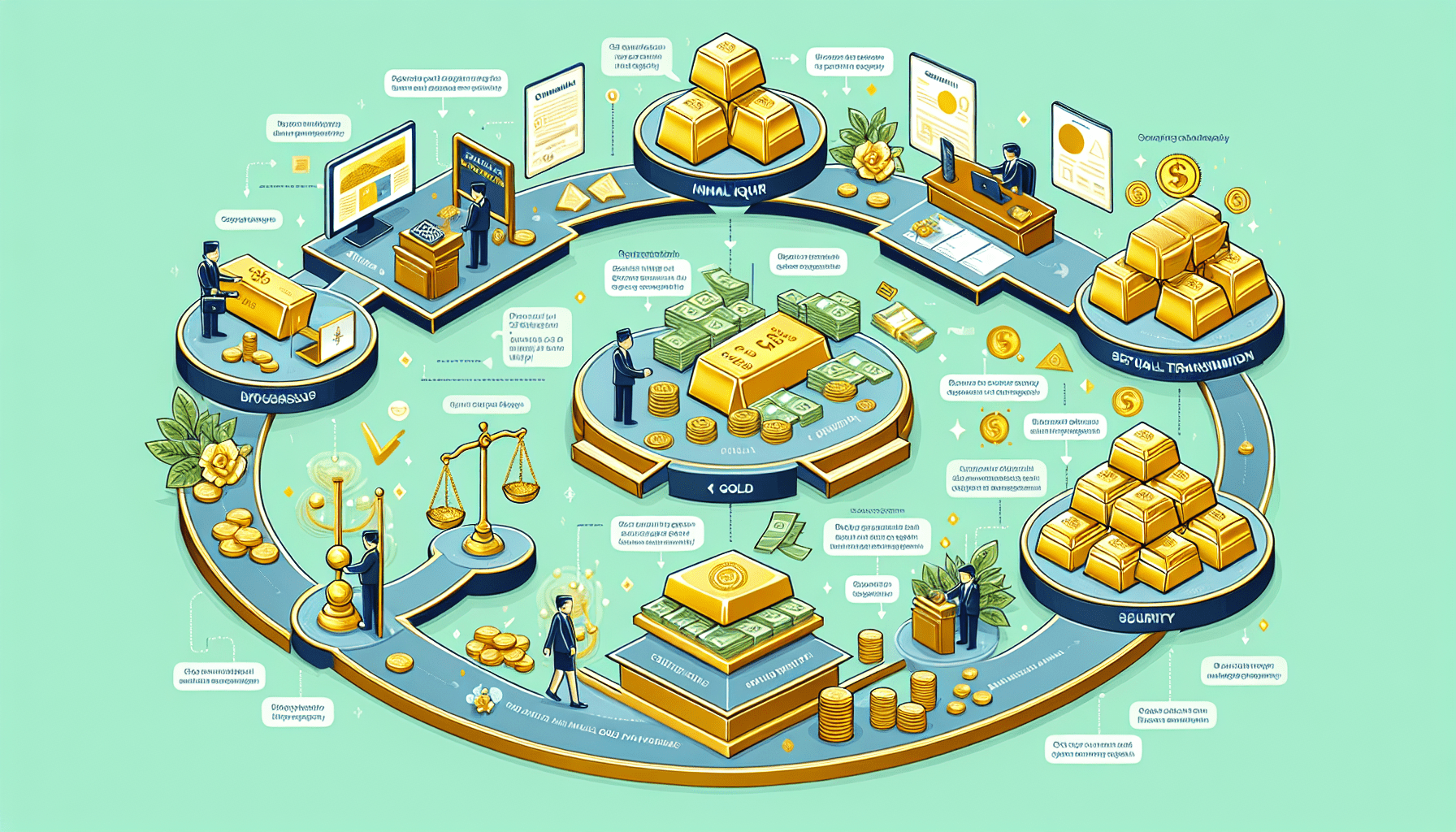

Opening a Gold Investment Account with the Chosen Bank

Now that you have chosen the bank and the type of gold you want to buy, it’s time to open a gold investment account with your chosen bank. Follow these steps to get started:

Contacting the bank and inquiring about their account opening procedures

To open a gold investment account, you will need to contact the bank and inquire about their specific account opening procedures. Each bank may have its own requirements and processes, so it is important to gather all the necessary information beforehand. You can contact the bank through their customer service helpline, visit their branch in person, or explore their website for detailed instructions.

Gathering the required documents, such as identification and proof of address

Before visiting the bank to open the account, ensure you have all the required documents in order. Typically, you will need to provide identification documents such as your IC or passport, as well as proof of address, such as utility bills or rental agreements. Prepare these documents in advance to save time during the account opening process.

Visiting the bank branch and completing the necessary paperwork

Once you have gathered all the required documents, visit the bank branch to open the gold investment account. The bank staff will guide you through the process and provide you with the necessary paperwork to complete. Take your time to read and understand the documents before signing them. If you have any questions or concerns, do not hesitate to ask the bank staff for clarification.

Providing any additional information or fulfilling any specific requirements

During the account opening process, the bank may require you to provide additional information or fulfill specific requirements. For example, they may need to verify the source of funds used to open the account or conduct a background check for compliance purposes. Be prepared to provide any requested information or satisfy any additional requirements to complete the account opening process.

Depositing Funds into the Gold Investment Account

After successfully opening a gold investment account, the next step is to deposit funds into the account. Follow these steps to ensure a smooth deposit process:

Transferring funds from your existing bank account to the gold investment account

To deposit funds into your gold investment account, you will need to transfer money from your existing bank account. Use the provided account details of your gold investment account to initiate the transfer. Depending on the bank, you may be able to transfer funds online, through mobile banking, or by visiting a bank branch. Choose the method that is most convenient for you.

Confirming the deposit and ensuring it reflects in your gold investment account

Once you have initiated the fund transfer, it is important to confirm that the deposit has been successful and reflects in your gold investment account. Check your account balance through your bank’s online banking platform or by contacting their customer service. If you do not see the deposit reflected in your account within a reasonable time frame, reach out to the bank for assistance.

Verifying the accuracy of the deposit amount and resolving any discrepancies

After confirming the deposit, verify the accuracy of the deposit amount. Make sure it matches the intended transfer amount and that there are no discrepancies. If you notice any discrepancies, such as an incorrect deposit amount or missing funds, contact the bank immediately to rectify the situation. It is important to resolve any potential issues promptly to ensure the integrity of your investment.

Understanding the minimum deposit requirements set by the bank

Each bank may have its own minimum deposit requirements for opening and maintaining a gold investment account. Familiarize yourself with these requirements to ensure you meet the minimum criteria. Failure to meet the minimum deposit requirements may result in account closure or additional fees levied by the bank.