If you’re looking for new ways to invest in gold, you might be wondering if it’s possible to do so through Malaysian peer-to-peer lending platforms. Peer-to-peer lending has become popular in recent years as an alternative investment option, but can it also be a way to get involved in the gold market? In this article, we will explore the potential for investing in gold through Malaysian peer-to-peer lending platforms and discuss the advantages and considerations of this unique investment opportunity.

Overview of Malaysian Peer-to-Peer Lending Platforms

Definition of Peer-to-Peer Lending

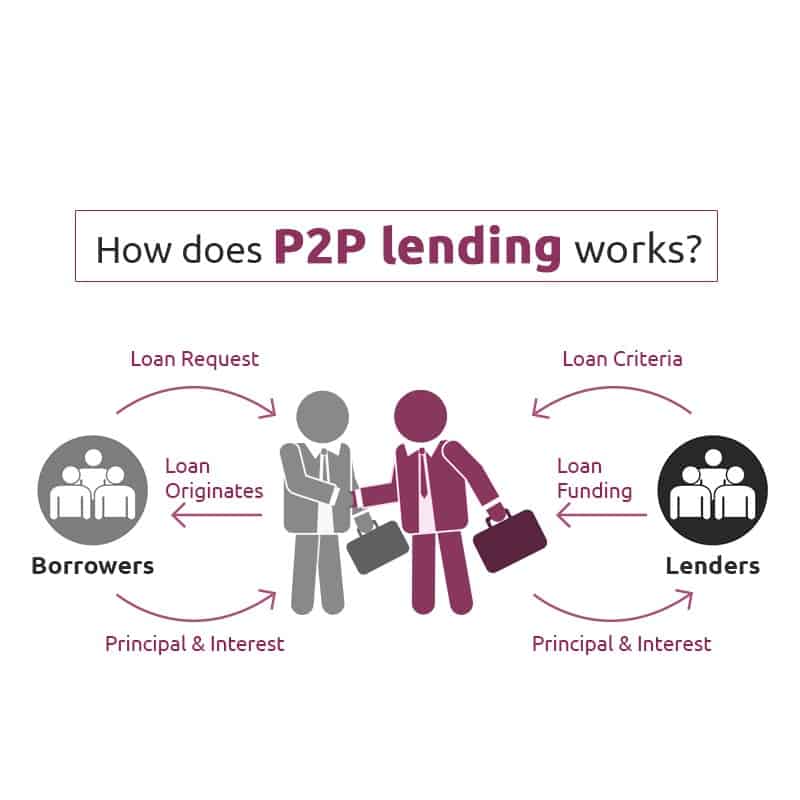

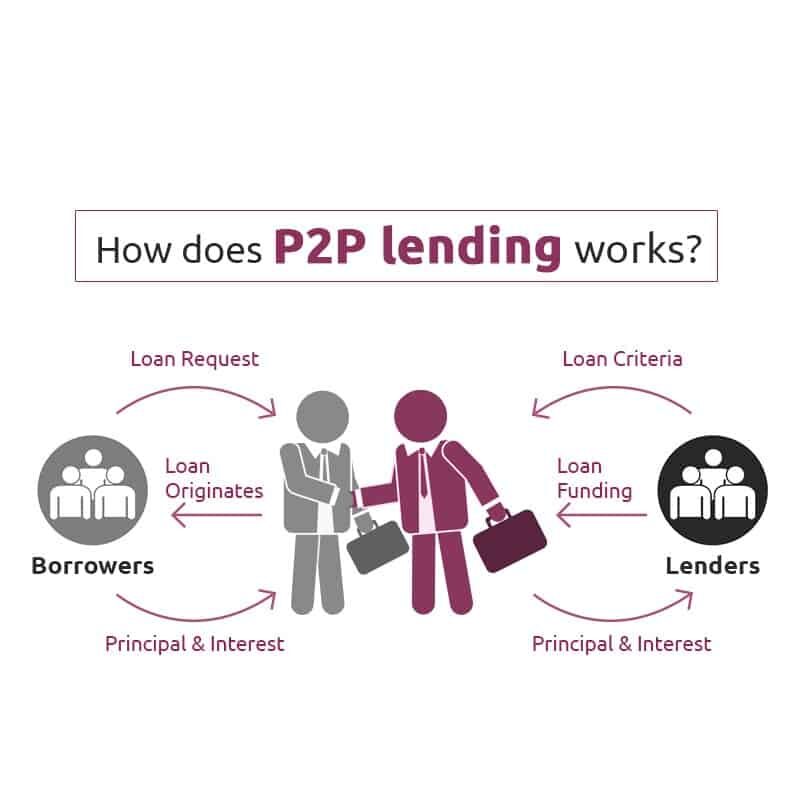

Peer-to-peer lending refers to the practice of individuals lending money to other individuals or businesses without the involvement of traditional financial institutions. In Malaysia, peer-to-peer lending platforms have gained popularity as a convenient and alternative way for borrowers to access financing and for investors to earn returns on their funds.

Regulation and Growth of Peer-to-Peer Lending in Malaysia

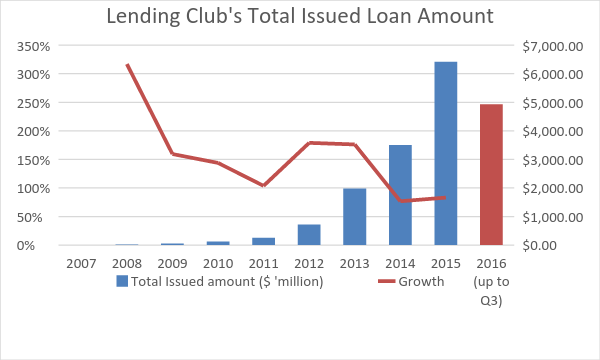

The peer-to-peer lending industry in Malaysia is regulated by the Securities Commission Malaysia (SC). The SC introduced the Regulatory Framework for Peer-to-Peer Financing (P2P) in 2016, which establishes rules and guidelines for the operation of peer-to-peer lending platforms in the country. Since then, the industry has experienced significant growth, with a growing number of platforms offering various investment opportunities.

Advantages and Risks of Peer-to-Peer Lending

Peer-to-peer lending platforms offer several advantages for both borrowers and investors. For borrowers, these platforms provide access to financing without the need to go through traditional banks. They offer competitive interest rates and flexible borrowing terms. For investors, peer-to-peer lending platforms offer an opportunity to diversify their investment portfolio and earn attractive returns.

However, like any investment, peer-to-peer lending has its risks. One of the main risks is the potential default of borrowers, which could result in a loss of invested capital. Additionally, the lack of regulation and investor protection mechanisms in the industry may expose investors to fraudulent activities or unreliable platforms. It is important for investors to conduct thorough due diligence and choose reputable platforms with a track record of successful lending.

Understanding Gold Investment

Types of Gold Investments

Gold investment can be made through various methods, each with its own characteristics and considerations. Some common types of gold investments include physical gold, gold exchange-traded funds (ETFs), gold mining stocks, and gold futures or options contracts. Each type offers different levels of risk and potential returns, and investors should carefully evaluate their investment goals and risk tolerance before choosing a particular type of gold investment.

Reasons to Invest in Gold

Gold has been considered a safe haven investment for centuries due to its stability and intrinsic value. There are several reasons why investors choose to invest in gold. Firstly, gold has historically acted as a hedge against inflation and currency devaluation. in times of economic uncertainty or market volatility, gold tends to hold its value and may even increase in price. Secondly, gold offers diversification benefits by providing an alternative asset class that is not directly correlated to traditional stocks and bonds. Finally, gold is a tangible asset that can be physically owned, providing a sense of security for investors.

Benefits and Risks of Gold Investment

Gold investment offers several benefits for investors. It can provide protection against inflation and serve as a hedge during times of economic uncertainty. Gold also has a long history of providing solid returns over the long term. Additionally, gold investments offer liquidity, as gold can easily be bought and sold in various forms.

However, gold investment is not without risks. Like any investment, the price of gold can be volatile, and investors may experience fluctuations in the value of their investments. Additionally, gold mining stocks can be affected by operational and geopolitical risks. It is important for investors to carefully assess these risks and consider their investment horizon and risk tolerance before allocating a portion of their portfolio to gold.

Integration of Gold Investment into Peer-to-Peer Lending Platforms

Introduction to Gold Investment in Peer-to-Peer Lending

Gold investment has found its way into peer-to-peer lending platforms as a new investment option for investors. This integration allows investors to diversify their peer-to-peer lending portfolios and potentially earn attractive returns through gold-related investments.

How Gold Investments Work on Peer-to-Peer Lending Platforms

On peer-to-peer lending platforms that offer gold investment options, investors can allocate a portion of their funds towards gold-related investments. These platforms typically partner with gold investment providers or companies that facilitate gold investments. Investors can choose from various gold investment products, such as gold-backed loans or investments in gold mining projects. The returns on these investments are typically based on the performance of the underlying gold assets.

Advantages and Disadvantages of Gold Investment on Peer-to-Peer Lending Platforms

There are several advantages of integrating gold investment into peer-to-peer lending platforms. Firstly, it provides investors with an additional investment option to diversify their portfolios and potentially increase their overall returns. Secondly, gold investments on peer-to-peer lending platforms may offer higher returns compared to traditional gold investment options. Lastly, investing in gold through peer-to-peer lending platforms offers investors the convenience of accessing multiple investments within a single platform.

However, there are also disadvantages to consider. The main disadvantage is the potential higher level of risk associated with gold investments on peer-to-peer lending platforms. As with any investment, there is a risk of default or loss of invested capital. Investors should carefully evaluate the credibility and reputation of the platform and the specific gold investment opportunities before committing their funds.

Exploring Malaysian Peer-to-Peer Lending Platforms for Gold Investment

Overview of Popular Peer-to-Peer Lending Platforms in Malaysia

In Malaysia, there are several popular peer-to-peer lending platforms that offer gold investment options. These platforms have established themselves as reputable and trustworthy platforms, providing opportunities for investors to invest in various types of gold-related investments.

Availability of Gold Investments on Peer-to-Peer Lending Platforms

The availability of gold investments on peer-to-peer lending platforms varies from platform to platform. Some platforms may offer a wide range of gold investment options, including gold-backed loans, investments in gold mining projects, or even investments in physical gold. Others may have more limited options or focus on specific types of gold investments. It is important for investors to research and compare different platforms to find the one that best suits their investment goals and preferences.

Criteria and Process for Investing in Gold Through Peer-to-Peer Lending Platforms

Investing in gold through peer-to-peer lending platforms typically involves a few key steps. Firstly, investors need to choose a platform that offers gold investment options and create an account. They will then need to complete the necessary Know Your Customer (KYC) verification process to comply with regulatory requirements. Once the account is set up and verified, investors can browse the available gold investment opportunities, assess the associated risks and potential returns, and make an informed investment decision.

Factors to Consider When Investing in Gold Through Peer-to-Peer Lending

Platform Credibility and Reputation

When investing in gold through peer-to-peer lending platforms, it is crucial to consider the credibility and reputation of the platform. Research the platform’s track record, read reviews from other investors, and ensure that the platform is regulated by the appropriate authorities. Choosing a reputable platform with a proven track record can significantly reduce the risk of investing in gold through peer-to-peer lending.

Transparency and Information

Investors should also pay attention to the level of transparency and information provided by the platform. Look for platforms that provide clear and comprehensive information about the gold investment opportunities, including the associated risks and potential returns. Transparent platforms that disclose relevant information and provide regular updates can help investors make well-informed investment decisions.

Diversification and Portfolio Strategy

Diversification is an important aspect of any investment strategy, including gold investments through peer-to-peer lending platforms. Consider investing in a diverse range of gold-related opportunities to spread the investment risk. Additionally, investors should have a well-defined portfolio strategy that aligns with their investment goals and risk tolerance. Regularly reviewing and adjusting the portfolio strategy can help optimize the returns and manage the associated risks.

Comparison of Gold Investment Options in Malaysia

Traditional Gold Investment Options

In addition to peer-to-peer lending platforms, there are several traditional gold investment options available in Malaysia. These include purchasing physical gold in the form of bars or coins, investing in gold ETFs, buying shares of gold mining companies, or trading gold futures or options contracts. Each option has its own advantages and disadvantages in terms of accessibility, liquidity, and potential returns.

Gold Investment through Peer-to-Peer Lending: Pros and Cons

Investing in gold through peer-to-peer lending platforms offers unique advantages and disadvantages compared to traditional gold investment options. One of the main advantages is the potential for higher returns, as some gold investment opportunities on peer-to-peer lending platforms may offer attractive interest rates or profit-sharing arrangements. Additionally, investing in gold through peer-to-peer lending platforms allows for diversification within a broader investment portfolio.

However, there are also drawbacks to consider. Peer-to-peer lending platforms typically involve higher risks compared to traditional gold investments due to the potential default risk of borrowers. The lack of regulation and investor protection mechanisms in the peer-to-peer lending industry may expose investors to fraudulent activities or unreliable platforms. It is crucial for investors to carefully assess the risks and rewards before investing in gold through peer-to-peer lending platforms.

Returns and Risk Comparison: Peer-to-Peer Lending vs. Traditional Gold Investments

When comparing the returns and risks of investing in gold through peer-to-peer lending platforms and traditional gold investments, it is important to consider the specific investment opportunities and the associated risk profiles. Peer-to-peer lending platforms that offer gold investments may provide higher returns compared to traditional gold investments, but this comes with higher risks such as potential defaults. Traditional gold investments, on the other hand, may offer lower returns but with more established risk profiles and historical performance data. Ultimately, investors should consider their investment goals, risk tolerance, and preferences when deciding between the two options.

Steps to Start Investing in Gold Through Malaysian Peer-to-Peer Lending Platforms

Choosing the Right Peer-to-Peer Lending Platform

To start investing in gold through Malaysian peer-to-peer lending platforms, the first step is to choose the right platform. Conduct thorough research on different platforms, compare their offerings, and consider factors such as reputation, track record, regulatory compliance, available gold investment options, and user reviews. Choose a platform that aligns with your investment goals and risk tolerance.

Creating an Account and Completing KYC Verification

Once a suitable peer-to-peer lending platform is chosen, the next step is to create an account. Follow the platform’s registration process and provide the necessary information and documentation. Most platforms require investors to complete a Know Your Customer (KYC) verification process to comply with regulatory requirements and ensure the integrity of the platform.

Understanding the Investment Process and Options

Before investing in gold through peer-to-peer lending platforms, it is essential to understand the investment process and options available. Familiarize yourself with the platform’s user interface, investment dashboard, and the specific gold investment opportunities. Read the investment details, including the associated risks, terms, and potential returns. If necessary, seek guidance or clarification from the platform’s customer support team.

Potential Challenges and Risks of Gold Investment through Peer-to-Peer Lending

Default Risk and Late Repayments

One of the main challenges of gold investment through peer-to-peer lending platforms is the risk of default by borrowers. Peer-to-peer lending platforms typically provide loans to individuals or businesses, and there is always a chance that borrowers may fail to repay the loan. This could result in a loss of invested capital or delayed returns for investors. It is important to carefully assess the creditworthiness of borrowers and choose platforms with robust risk management systems in place.

Market Volatility and Price Fluctuations

Investing in gold exposes investors to the volatility and price fluctuations of the gold market. The value of gold can be influenced by various factors, including global economic conditions, political events, and supply and demand dynamics. These factors can cause significant fluctuations in the price of gold, potentially impacting the returns on gold investments. Investors should be prepared for short-term price volatility and maintain a long-term investment perspective.

Liquidity and Exit Strategies

Another challenge of gold investment through peer-to-peer lending platforms is the liquidity of the investment. Unlike traditional gold investments, which can be easily bought or sold in the market, investments in gold through peer-to-peer lending platforms may have limited liquidity. This means that it may not be easy to exit the investment or access the invested funds before the maturity of the investment. Investors should carefully consider their liquidity needs and have a clear exit strategy in place before investing in gold through peer-to-peer lending platforms.

Tips for Successful Gold Investment through Peer-to-Peer Lending Platforms

Research and Due Diligence

Thorough research and due diligence are essential for successful gold investment through peer-to-peer lending platforms. Take the time to research different platforms, understand their track record, and assess the associated risks. Research the specific gold investment opportunities and evaluate the credibility and reputation of the borrowers or gold investment providers. Make informed investment decisions based on reliable information and data.

Diversification and Risk Management

Diversification is key to managing risk in gold investment through peer-to-peer lending platforms. Allocate your investment across different types of gold investments or spread your investment across multiple platforms. This helps to minimize the exposure to any individual investment or platform and spreads the risk across a broader portfolio. Additionally, consider your risk tolerance and invest an amount that you are comfortable with, considering the potential losses and fluctuations in the gold market.

Regular Monitoring and Review

Successful gold investment through peer-to-peer lending platforms requires regular monitoring and review of your investments. Stay updated on the performance of your investments, monitor any changes in the market or economic conditions that may impact the value of your investments, and regularly review your investment strategy. This allows you to make necessary adjustments and optimize your returns while managing the associated risks.

Conclusion

Investing in gold through Malaysian peer-to-peer lending platforms offers investors a unique opportunity to diversify their investment portfolios and potentially earn attractive returns. However, it is crucial to carefully consider the advantages, risks, and challenges associated with gold investment through peer-to-peer lending platforms. Conduct thorough research, choose reputable platforms, and practice risk management strategies to increase the chances of successful gold investment. With the right approach and due diligence, investors can navigate the world of gold investments through peer-to-peer lending platforms and potentially achieve their investment goals.